SRINAGAR, India: India‘s parliament on Wednesday began discussing a controversial proposal by Prime Minister Narendra Modi’s Hindu nationalist government to amend laws governing Muslim land endowments in the country.

The bill would add non-Muslims to boards that manage waqf land endowments and give the government a larger role in validating their land holdings.

The government says the changes will help to fight corruption and mismanagement while promoting diversity, but critics fear that it will further undermine the rights of the country’s Muslim minority and could be used to confiscate historic mosques and other property from them.

Minority Affairs Minister Kiren Rijiju introduced the Waqf Amendment Bill on Wednesday, which would reform a 1995 law that set rules for the foundations and set up state-level boards to administer them.

Debate in the parliament’s Lower House is expected to be heated as the Congress-led opposition is firmly against the proposal. Modi’s ruling Bharatiya Janata Party does not have a majority but may be able to depends on allies to pass the bill. Both BJP and the Congress have asked their lawmakers to be present in the House.

If passed, the bill will need to clear the Upper House before it is sent to President Droupadi Murmu for her assent to become a law.

Many Muslim groups as well as the opposition parties say the proposal is discriminatory, politically motivated and an attempt by Modi’s ruling party to weaken the minority rights.

The controversial bill was first introduced in parliament last year, but was later sent to a committee of lawmakers for discussion after opposition parties raised concerns. The committee’s report was tabled in both houses of parliament on Feb. 13 amid protests by opposition leaders who said that their inputs were ignored. The government claims that opposition parties are using rumors to discredit them and block transparency in managing the endowments.

What’s a waqf?

Waqfs are a traditional type of Islamic charitable foundation in which a donor permanently sets aside property — often but not always real estate — for religious or charitable purposes.

Waqfs in India control 872,000 properties that cover 405,000 hectares (1 million acres) of land, worth an estimated $14.22 billion. Some of these endowments date back centuries, and many are used for mosques, seminaries, graveyards and orphanages.

Law would change who runs waqfs

In India, waqf property is managed by semi-official boards, one for each of the country’s states and federally-run union territories. The law would require non-Muslims to be appointed to the boards.

Currently, waqf boards are staffed by Muslims, like similar bodies that help administer other religious charities.

One of the most controversial amendments is the change to ownership rules, which potentially could impact historical mosques, shrines and graveyards under the waqf. It could change the ownership rules of many of these properties which lack formal documentation as they were donated without legal records decades, and sometimes, even centuries ago.

Questions about title

Other changes could impact historic mosques, whose land is often held in centuries-old waqfs.

Hindu radical groups have targeted mosques across the country and laid claim to several of them, arguing they are built on the ruins of important Hindu temples. Many such cases are pending in courts.

The law would require waqf boards to seek approval from a district level officer to confirm waqfs’ claims to property.

Critics say that would undermine the board and could lead to Muslims being stripped of their land. It’s not clear how often the boards would be asked to confirm such claims to land.

Fears among Muslims

While many Muslims agree that waqfs suffer from corruption, encroachments and poor management, they also fear that the new law could give India’s Hindu nationalist government far greater control over Muslim properties, particularly at a time when attacks against the minority communities have become more aggressive under Modi, with Muslims often targeted for everything from their food and clothing styles to inter-religious marriages.

Last month, the US Commission on International Religious Freedom said in its annual report that religious freedom conditions in India continued to deteriorate while Modi and his party “propagated hateful rhetoric and disinformation against Muslims and other religious minorities” during last year’s election campaign.

Modi’s government says India is run on democratic principles of equality and no discrimination exists in the country.

Muslims, which make 14 percent of India’s 1.4 billion population, are the largest minority group in the Hindu-majority nation but they are also the poorest, a 2013 government survey found.

Indian government tables bill to take over centuries-old waqf management from Muslims

https://arab.news/4b3w4

Indian government tables bill to take over centuries-old waqf management from Muslims

- The bill would add non-Muslims to boards that manage waqf land endowments and give the government a larger role in validating their land holdings

- The government says the changes will help to fight corruption and mismanagement while promoting diversity

Pakistani bowler Usman Tariq reported for suspect bowling action in PSL

- Tariq reported by on-field umpires Ahsan Raza and Chris Brown after Quetta lost to Lahore Qalandars by 79 runs

- Last year, Tariq was also reported for a suspect bowling action during Quetta’s match against Karachi Kings

ISLAMABAD: Quetta Gladiators’ off-spinner Usman Tariq of Pakistan was reported for a suspect bowling action during the Pakistan Super League T20 tournament.

Tariq was reported by on-field umpires Ahsan Raza and Chris Brown after Quetta lost to Lahore Qalandars by 79 runs at Rawalpindi on Sunday. Tariq bowled his quote of four overs and returned figures of 1-31.

He also picked up 2-26 against Peshawar Zalmi as Quetta began its campaign with a thumping 80-run win.

“As per the rules, Usman can continue to bowl in future (PSL) matches,” the Pakistan Cricket Board said in a statement. “However, if he is reported again, he will be suspended from bowling and will need to obtain clearance from an ICC-accredited lab before he can resume bowling.”

Last year, Tariq was also reported for a suspect bowling action during Quetta’s match against Karachi Kings at the same venue before the franchise voluntarily pulled out the off-spinner from the tournament to undergo the bowling test.

Later in last August, an ICC-accredited laboratory in Lahore cleared the off-spinner’s bowling action and he competed in domestic tournaments without being reported.

Madinah festival celebrates global culture, traditions

MADINAH: Prince Salman bin Sultan, the governor of Madinah, inaugurated the 13th International Cultural Festival, organized by the Islamic University of Madinah.

Several officials and diplomats from Arab and Islamic countries attended the opening ceremony for the festival, which runs from April 13 to 19, the Saudi Press Agency reported.

University President Saleh Alagla thanked the governor for his patronage and continued support of the university, which has graduated more than 100,000 students from 170 countries.

Spanning 28,000 sq. meters, the festival features students from 90 countries and offers more than 150 events and activities for families and children, including Saudi Coffee Day and Arabic Poetry Day.

With more than 100 pavilions, the festival is a display of diverse cultures, heritage, fashion, and traditions of students from around the world.

The event also celebrates the Year of Handicrafts and highlights the Kingdom’s support for scholarship students, according to the SPA.

A symposium will focus on promoting moderation, tolerance, and rejecting extremism, with expert speakers offering their insights.

Saudi Arabia, US to deepen mining ties after high-level talks with Energy Secretary Chris Wright

JEDDAH: Saudi Arabia and the US are poised to strengthen mining ties following high-level talks in Riyadh, where both sides discussed boosting investment, economic cooperation, and critical mineral supply chains.

Minister of Industry and Mineral Resources Bandar bin Ibrahim Alkhorayef met with US Secretary of Energy Chris Wright on April 13, as part of the White House official’s ongoing visit to the Kingdom, according to the Saudi Press Agency.

The meeting, which was also attended by Deputy Minister of Industry and Mineral Resources for Mining Affairs Khalid bin Saleh Al-Mudaifer, focused on strengthening the strategic partnership between Saudi Arabia and the US in the mining and minerals sector.

In a post on his X account, Alkhorayef said: “I met with US Secretary of Energy Chris Wright at the Ministry’s headquarters in Riyadh, where we focused on enhancing strategic cooperation in the mining sector. We also discussed future partnership prospects and reviewed the long-standing industrial relations between our two countries.”

Discussions explored ways to expand bilateral cooperation in mining, with an emphasis on the sector’s critical role in the global energy transition, advanced technologies, and clean energy-driven economies.

The talks also highlighted the importance of minerals in electric vehicle production and their components, identified key investment opportunities, and examined mechanisms to unlock their potential. Both sides reaffirmed their commitment to strengthening economic collaboration and deepening long-standing ties.

Alkhorayef extended an invitation to Wright to attend the 2026 Future Minerals Forum, scheduled to be held in Riyadh.

The Kingdom aims to position mining as a foundational pillar of its industrial economy, with its mineral wealth estimated at SR9.4 trillion ($2.4 trillion), according to official figures.

Attracting international investment in the mining sector is central to Saudi Arabia’s ambition to reach $100 billion in annual foreign direct investment by the end of the decade.

In March, the Kingdom announced a new incentive package to boost FDI in the mining industry, underscoring its broader strategy to diversify the economy and tap into its untapped mineral reserves.

The initiative reflects close coordination between the ministries of investment and industry through an exploration enablement program aimed at streamlining market entry for exploration firms.

The program also seeks to enhance geological surveying and foster a competitive investment environment for both local and international mining companies.

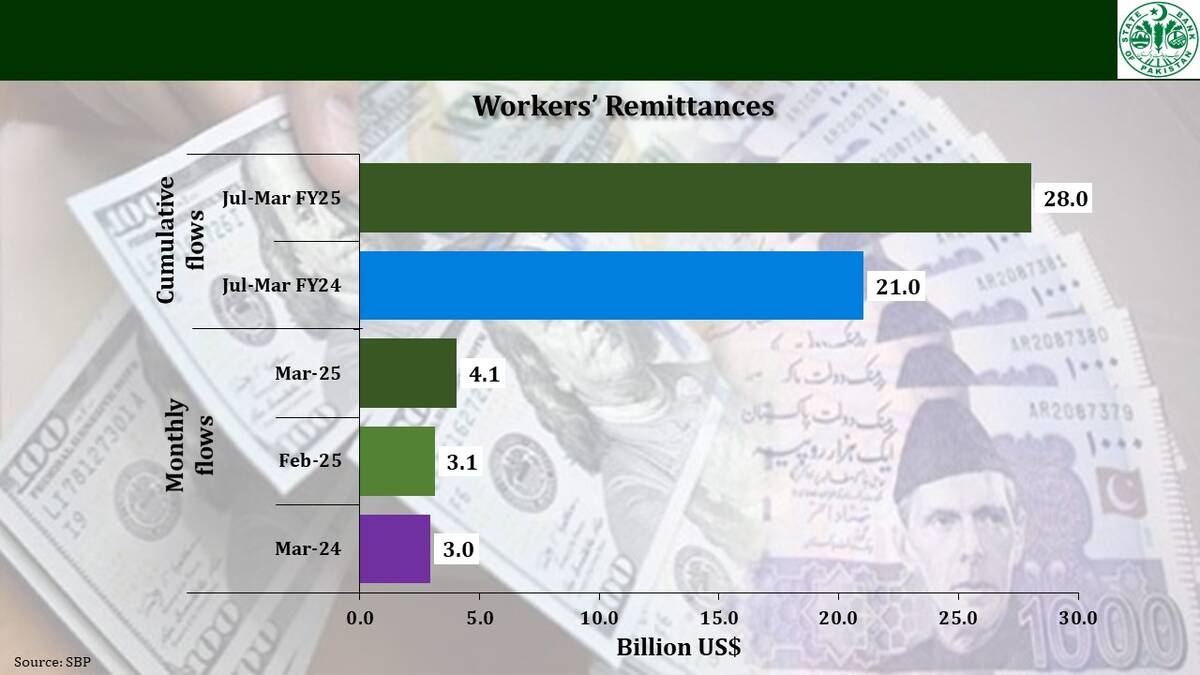

Pakistan remittances cross record $4 billion in March, Saudi Arabia remains top contributor

- Government expects economy to expand three percent this year against earlier projections of 2.5-3.5 percent

- The country broke its own record in February 2025 when overseas Pakistanis sent $3.1 billion back home

KARACHI: Pakistan’s central bank governor on Monday said the current account would show a “substantial” surplus this year through June mainly on the back of a record inflow of remittances which crossed the $4 billion mark in March, with Saudi Arabia once again topping the list of biggest contributors.

Pakistan received a record-high $4.1 billion in remittances in March 2025, which bodes well for the government’s efforts to revive an economy that it expects will expand three percent this year, State Bank of Pakistan (SBP) governor Jameel Ahmad said at an event at Pakistan Stock Exchange in Karachi.

The central bank had earlier projected economic growth to range from 2.5 percent to 3.5 percent.

“With this level of remittances, we are hoping that for the current fiscal year our current account will stay in surplus,” the governor said. “There will be a substantial surplus and this surplus is the best performance, I will say, on the external account during the last two decades.”

The country broke its own record in February when overseas Pakistanis remitted $3.1 billion.

Pakistan has faced a serious shortage of dollars and had to restrict imports in 2023 to avoid an imminent default on its foreign debts, which was avoided with the help of a last-gasp $3 billion financial bailout from the International Monetary Fund (IMF).

Prime Minister’s Shehbaz Sharif’s government is now waiting for the IMF’s executive board to approve the next $1 billion tranche of a new program, approved in September last year, to boost foreign exchange reserves that currently stand at $10.6 billion.

The current trend in the worker remittances inflows, Ahmad said, had made the central bank revise its earlier projection of $36 billion to $38 billion for this financial year. On the basis of such healthy inflows, the country’s foreign exchange reserves were expected to surge beyond $14 billion this year.

Ahmad said the country had paid most of its external debt for FY25 and was expected to receive as much as $5 billion from external sources by the end of June.

“I am quite confident that we will be receiving $4 to $5 billion before the end of June this year,” he said, without mentioning the exact source of these funds.

Pakistan’s total debt liabilities this year amounted to $26 billion of which $16 billion was supposed to be rolled over or refinanced, the governor said. Of this, he said, $3.7 billion debt was refinanced while close to $12.4 billion has been rolled over by friendly countries including China, Saudi Arabia and the UAE.

Out of the remaining $10 billion debt, Pakistan has already repaid $8 billion and was required to repay only $2 billion in the remaining months of this year.

“We have been servicing all those debt obligations on time,” said the SBP governor, adding that some inflows were delayed, but these would also come before June 30.

Jameel said Pakistan’s current account was stable and showed a $700 million surplus this year through February. Last year, the country’s current account showed $1.7 billion, close to half percent of GDP.

“Good thing is that we have been able to achieve this surplus despite substantial increase in imports,” he said, rejecting the claims that the government was still restricting imports.

Pakistan was also spending around $5.7 billion every month on oil and non-oil imports.

Due to the current account surplus and other policy and regulatory measures like exchange companies’ reforms, the Pakistani rupee had stabilized.

“The gap between the interbank market and the open market is very narrow,” Ahmad said.

While the economy was expected to grow three percent this year compared with 2.5 percent last year, agriculture was a major drag on economic expansion this year and rose less than one percent during the first six months through December.

Otherwise, he said, the economy was “doing well.”

“You can see the economic activity has already picked up. This is reflected in our high frequency data. Look at cement sales, look at auto sales, look at the high value textile exports,” Ahmad said.

While inflation was one of his biggest concerns previously, the central bank governor said the pace of price hikes had slowed to 0.7 percent last month, the lowest level in six decades.

Consumer prices in Pakistan have been backbreaking in recent years and rose 38 percent in May 2023. Pakistan’s central bank had to halve its interest rate to 12 percent since June last year to tame inflation in the country of more than 240 million people.

“From the current month onward, the inflation will be rising and ultimately stabilize within the target range of 5 to 7 percent [in the full year],” the central bank chief added.

Meanwhile, March 2025 data on remittances showed remittances reached $ 4.1 billion last month, a record high. In terms of growth, remittances increased by 37.3 percent and 29.8 percent on y/y and m/m basis, respectively.

Cumulatively, with an inflow of $ 28.0 billion, workers’ remittances increased by 33.2 percent during Jul-Mar FY25 compared to $ 21.0 billion received during Jul-Mar FY24.

“Remittances inflows during March 2025 were mainly sourced from Saudi Arabia ($987.3 million), United Arab Emirates ($842.1 million), United Kingdom ($683.9 million) and United States of America ($419.5 million),” the data showed.

Kurdistan regional government commemorates 37th anniversary of Anfal genocide

- The event paid tribute to the tens of thousands of Kurds who were systematically targeted and killed by the former Iraqi regime during the 1988 Anfal campaign

DUBAI: The Kurdistan Regional Government held a ceremony to mark the 37th anniversary of the Anfal genocide, Iraq state news reported on Monday.

Organized by the Ministry of Martyrs and Anfal Affairs, the event paid tribute to the tens of thousands of Kurds who were systematically targeted and killed by the former Iraqi regime during the 1988 Anfal campaign.

Named after the eighth sura of the Qur’an, “Anfal” became a codename for a brutal military operation led by Saddam Hussein’s cousin, Ali Hassan Al-Majid — infamously known as “Chemical Ali.”

Over the course of several months, Iraqi forces conducted mass executions, used chemical weapons, and destroyed more than 2,000 Kurdish villages. Entire families were arrested, displaced, or disappeared, with many perishing due to disease, malnutrition, or exposure after being forcibly relocated.

Kurdish officials called for continued recognition of the Anfal as an act of genocide and reaffirmed their commitment to preserving its memory for future generations.