DUBAI: In a masterpiece of understatement, Amin Nasser summed up 2020 at a recent awards ceremony. “This year has been challenging,” the president and chief executive of Saudi Aramco told journalists.

Prospects looked very different just over a year ago, when Aramco made its debut on the Tadawul stock exchange in Riyadh in the world’s biggest initial public offering (IPO), becoming the world’s most valuable company in the process.

Having pulled off that complex piece of financial engineering, four years in the making, the life-time Aramco man could have been excused for seeking a period of respite. But it was not to be.

Within a couple of months, global demand for oil had been savaged by the coronavirus pandemic, and Aramco had to think again about the financial assumptions on which the world-beating IPO had been constructed.

“My generation hasn’t seen anything like this. I don't think the world has seen anything like this,” Nasser said, this time eschewing the restraint about what, by general industry consensus, has been the most difficult period in the 150-year history of the oil industry.

Saudi Aramco has endured the onset of the coronavirus disease pandemic, not to mention a series of attacks on its facilities, and still became biggest oil producing company in history this year. (Supplied/Aramco)

Financial experts agreed. “The first year was tumultuous for Aramco and oil producers,” economics expert Nasser Saidi told Arab News.

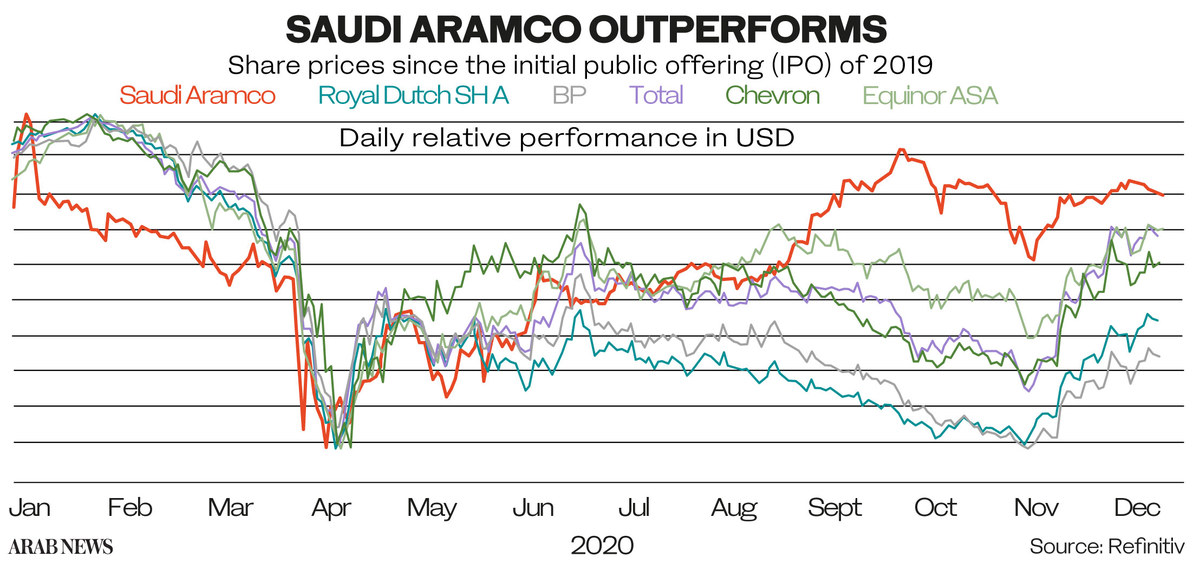

But Aramco has got through the year in good shape, with the promises it made in the IPO intact, its share price riding high (in comparison with other quoted oil companies), and with its long-term strategy still in place.

Not many of its peers can say the same. The big six independent oil companies against which Aramco compares itself were all obliged to either write down the value of their assets, or slash dividends, or accelerate plans to move out of the hydrocarbon industry altogether. All saw their share prices plummet in line with crude prices.

In the US, many producers of shale oil simply went out of business altogether, unable to live with the consequences of the “new normal” of low oil prices.

Of course, Aramco was not immune from the effects of the pandemic crisis. No oil company could be, as falling crude prices changed the fundamental economic assumptions of the global business. But it appears to have navigated its way through the carnage better than the rest.

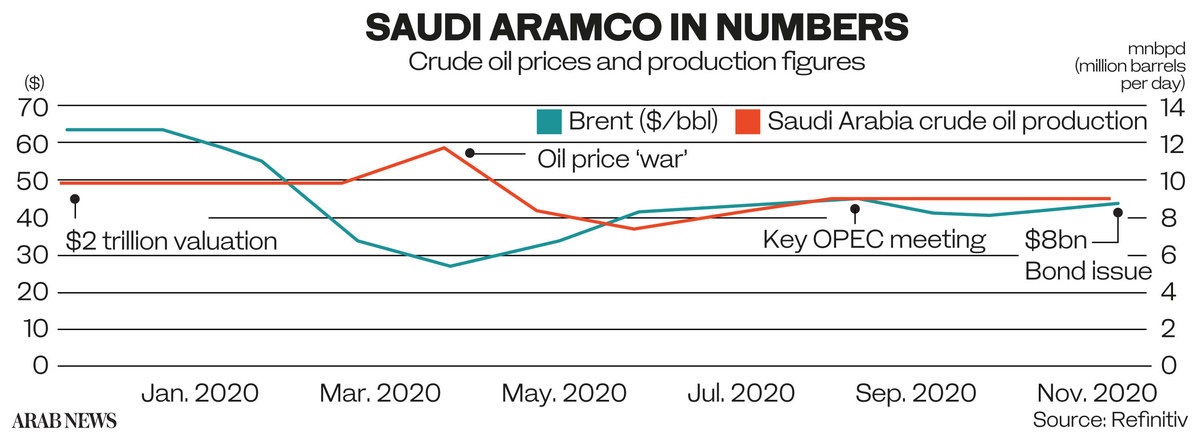

Nowhere is this more obvious than in the relative share price performance of Aramco and its peers. After the euphoric aftermath of the IPO, its shares briefly soared — hitting the $2 trillion target desired by the owners — but then fell back in comparison with the likes of ExxonMobil, Shell, BP, Chevron, Total and Equinor as investors took profits from the share flotation.

The onset of the crisis saw all energy stocks dropping sharply, with Aramco suffering a bigger proportionate drop than some as a perceived victim of the brief “oil price war” that flared in March and April.

But from the summer onwards, as Aramco’s low-cost advantages and deep financial resources became apparent, and when some stability was restored to global oil markets under OPEC+ discipline, the trend was reversed.

By autumn, Aramco was trading at a significant premium to the oil giants, a position it retains even as the price of crude rose and all energy share prices recovered to some degree on the back of encouraging vaccine developments.

The attractions of the Aramco share price were highlighted by the American banking giant JP Morgan, whose analyst Christyan Malek recommended investors to buy the shares on the basis of Aramco’s “near term resilience and volume-led medium term growth optionality.”

One big reason for Aramco’s continuing share price strength is its commitment to paying an annual dividend to shareholders of $75 billion per year. This comparatively high level of payout was a feature of the IPO. Investors want a decent return on their holdings, as well as the upside possibility that the shares themselves will increase in value.

As the pandemic ravaged oil companies’ balance sheets in the spring and summer, all of Aramco’s peer group found themselves struggling to maintain their levels of dividend payments. BP, for example, cut its payout in half — the first reduction in 10 years.

In contrast, Aramco took pride in telling shareholders that it was sticking to its IPO pledges. In the run-up to the stock-market listing, particular attention was paid to ensuring that potential investors would receive dividend payments commensurate with Aramco’s status as one of the most cash-generative companies in the world.

It promised that it would pay $75 billion in dividends to shareholders, among which the government of Saudi Arabia is by far the biggest. It also ring-fenced payments to non-government holders in the event that revenues were not sufficient to cover payouts.

It kept that promise in 2021, despite the financial constraints of a low oil price and reduced demand for oil during the pandemic lockdowns. It raised $8 billion on international bond markets towards the end of the year to fund ongoing operations and meet financial commitments.

Aramco became the biggest oil producing company in history in April. (Supplied)

Malek of JP Morgan said that Aramco’s capacity to defend its “superior $75 billion dividend” was reinforced by its low costs of production, strong cash flow, and flexibility on capital expenditure. “We believe a 4.3 percent yield is increasingly attractive” compared to its peer group in the independent oil sector,” he added.

The big corporate event of the IPO year was the completion of the $70 billion deal to acquire SABIC, the Saudi petrochemicals giant. This had been flagged up well in advance of the IPO as an essential strategic move, putting Aramco at the forefront of the global petrochemicals industry, which is expected to continue growing even as demand for oil dwindles in the decades to come. “We expect to be a major global player in chemicals,” Nasser said.

In operational terms, the first year as a public company missed the big dramas of 2019, when projectile attacks on Aramco facilities at Abqaiq and Khurais led to one of the biggest temporary reductions of oil production ever. But the lessons learned from dealing with that emergency were put to good use in handling a series of smaller and less damaging attacks on Aramco facilities in 2020, after which facilities were repaired and remained fully operational with no disruption to supply.

In fact, Aramco became the biggest oil producing company in history in April when output touched 12 million barrels a day, before OPEC+ put in place its historic deal to reduce global supplies by 9.7 million barrels. The other big benefit from Aramco’s first year as a listed company was felt by Saudi stock markets.

Aramco took pride in telling shareholders that it was sticking to its IPO pledges. (AFP)

The decision to focus on the Kingdom’s financial markets, rather than go for a big global listing in foreign financial centers, disappointed some international financial investors, but was a boost for the Tadawul in a see-saw year for global markets.

The Riyadh index had one of its best years on record, with several Saudi companies following Aramco’s example and floating shares on the market. Companies raised some $1.5 billion in flotations on the Tadawul after the Aramco IPO, making it one of the best performers globally for share flotations.

More corporate activity is set for 2021, with Aramco having hired financial advisers to pave the way for money-spinning asset disposals. Its pipeline business is reportedly earmarked for some capital-raising transaction, which could include a market listing among other options.

“Aramco has opened the path for the privatization of GCC national oil companies and of the energy infrastructure across the region,” Saidi said.

“The IPO was a game changer, part of a long-term strategy of reducing dependence on oil and gas wealth and using the proceeds to diversify the Saudi economy. Aramco is a global player, is resilient, with a clear strategy of diversifying its activities and sources of revenue, and with improved corporate governance as a result of its public listing.”

Twitter: @frankkanedubai