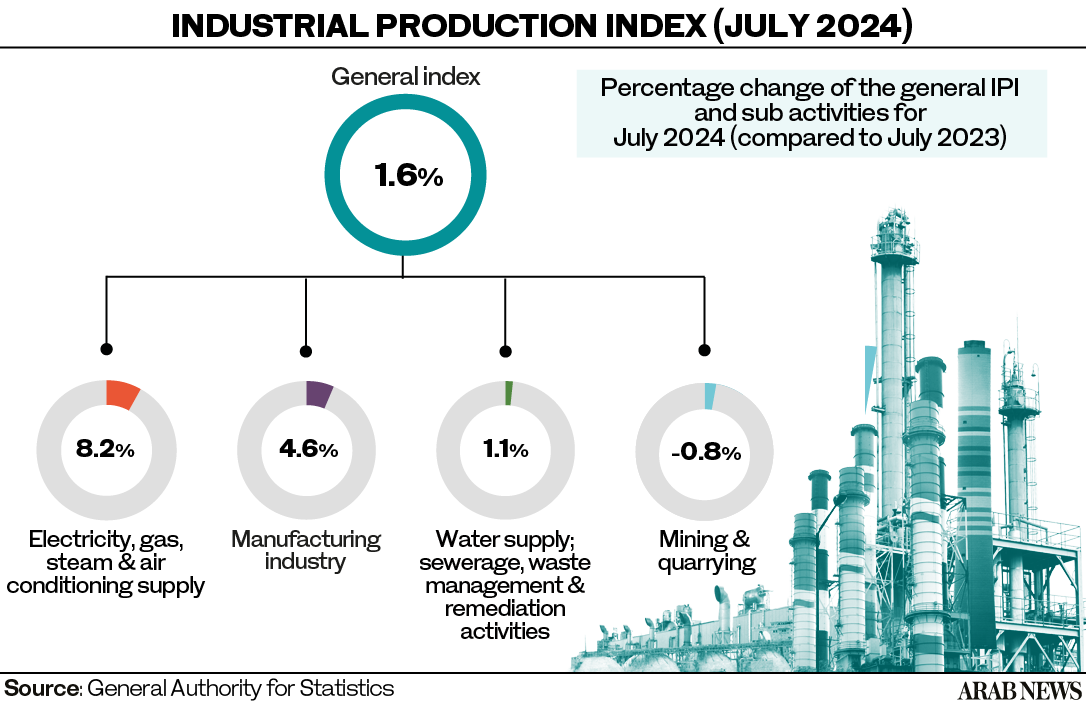

RIYADH: Saudi Arabia’s Industrial Production Index rose 1.6 percent in July, compared to the same month last year, driven by a surge in manufacturing activity, official data showed.

According to data from the General Authority for Statistics, manufacturing activities grew 4.6%, lifting the Kingdom’s IPI to 106.2 points for the month.

GASTAT revealed that this rise in the manufacturing sector was propelled by an increase in the manufacturing of chemical products, and food items, which surged by 5.7 percent and 10.1 percent, respectively.

Saudi Arabia’s strong manufacturing growth is pivotal to achieving the goals outlined in Vision 2030, as the Kingdom works to diversify its economy and reduce reliance on oil.

GASTAT, however, noted that mining and quarrying activity fell by 0.8 percent year on year in July, attributed to Saudi Arabia’s decision to cut oil production to 8.9 million barrels per day in line with OPEC+ agreements.

“The index for oil activities in July decreased by 1.1 percent compared to the same month of the previous year, due to the decline in oil production. While the index for non-oil activities increased by 8.2 percent, supported by an increase in all non-oil economic activities,” stated GASTAT.

To stabilize the market, Saudi Arabia reduced oil production by 500,000 barrels per day in April 2023, a cut that has been extended until December 2024.

Electricity, gas, steam, and air conditioning supply activities posted an 8.2 percent year-on-year increase in July, while water supply, sewerage, waste management, and remediation activities rose by 1.1 percent.

On a month-on-month basis, manufacturing activity increased by 1.7 percent, driven by a 3.3 percent rise in the production of coke and refined petroleum products.

Additionally, mining and quarrying activities increased by 1.3 percent in July compared to June.

“Based on the month-on-month trend, the index of oil activities and non-oil activities increased by 1.6 percent and 1.8 percent, respectively,” added GASTAT.

The IPI is an economic indicator that measures changes in industrial output based on production surveys.