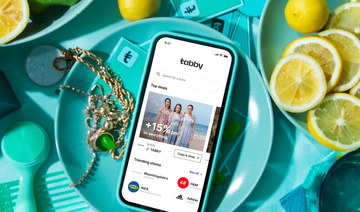

CAIRO: In recognition of Saudi Arabia’s booming financial technology sector, UAE’s Tabby, a forerunner in the buy now, pay later fintech space, is shifting its headquarters to Saudi Arabia as it gears up for its initial public offering.

The decision comes as the company inked a memorandum of understanding with the Kingdom’s Ministry of Investment.

Concurrently, Tabby is laying the groundwork for its IPO on the Saudi stock exchange.

The company intends to strategically strengthen its presence in its largest market, given that 80 percent of its customers hail from the Kingdom.

“With this move, we aim to amplify our reach and impact, reinforcing our commitment to deliver unparalleled financial solutions to our customers in the region. We’re equally dedicated to fostering local talent and contributing to the growth of the Saudi economy,” as stated by Tabby’s official account on X, formerly known as Twitter.

Moreover, Tabby recently received the green light from the Saudi Central Bank after obtaining a permit to expand its operation into the Kingdom.

“Millions of people in Saudi Arabia rely on Tabby today, so it’s an incredibly important step to crystalize our foundations in the Kingdom and continue building toward financial freedom for our community,” Tabby’s CEO Hosam Arab told Arab News in August.

Tabby’s strategies perfectly align with the Kingdom’s aspirations to drive financial inclusion and literacy as a cornerstone of the country’s economic growth.

Arab also lauded the Saudi government’s measures to help boost the fintech sector. The CEO said the encouraging regulatory landscape will help instill confidence in Tabby to introduce innovative services in the Kingdom.

Currently operational in Saudi Arabia, the UAE, and Kuwait, Tabby holds a valuation of $660 million following its latest funding round from investors including Sequoia Capital India, STV, PayPal Ventures, Mubadala Investment Capital, Arbor Ventures, and Endeavor Catalyst.

Furthermore, the company has over 15,000 worldwide brands and small enterprises, including H&M, Adidas, IKEA, SHEIN, noon, and Bloomingdale’s, that utilize its technology to stimulate growth and build a faithful customer base by offering flexible payment options both online and in-store.

UAE’s esports Fanzword raises $1.2m in a pre-seed round

UAE-based esports startup Fanzword has successfully raised $1.2 million in a pre-seed funding round, spearheaded by XVC Tech, and supported by several regional angel investors.

Launched in 2021 by Ibrahim El-Mohdar and Amr El-Beheiry, Fanzword positions itself as a unique football fan engagement platform. It envisions creating a virtual stadium experience where aficionados can not only track their favorite teams but also connect, interact, and accrue rewards.

“We believe that it’s the perfect time to leverage a Football Fan Engagement Platform in the Middle East,” said El-Mohdar, CEO at Fanzword.

“Especially after the resounding success of the World Cup in Qatar and the Saudi Pro League’s blockbuster signings of football legends like Ronaldo, Neymar Jr., and Benzema,” he added.

With capital in hand, Fanzword aims to amplify its regional footprint and further tap into its web3 gaming capabilities.

The company claims to have over 250,000 downloads while achieving more than 100 percent growth in 2022.

“We believe that the partnership with Fanzword will not only reshape web3 gaming but also accelerate the adoption of NextGen Technology Solutions in the Middle East and beyond,” Johan Lundberg, founding partner and board member at XVC Tech, said.

Cypherleak raises $750k seed round to simplify cyber risk monitoring

UAE’s cyber risk monitoring and scoring startup, Cypherleak, has successfully secured $750,000 in a seed funding round.

The investment attracted notable participation from entities spanning Abu Dhabi, Morocco, and Qatar, including the Maroc Numeric Fund II and the Qatar Insurance Company.

Incepted in 2022 by Mohamed Belarbi, Cypherleak offers advanced risk monitoring solutions tailored for smaller businesses, effectively obviating the need for in-depth cybersecurity technical knowledge.

Mohamed Belarbi’s Cypherleak offers advanced risk monitoring solutions. (Supplied)

This infusion of capital is set to bolster Cypherleak’s growth ambitions across the Middle East and Africa.

“The funding injection will enable us to accelerate our expansion across the Middle East and Africa, fortifying our position as a leading player in the rapidly evolving field of cyber risk management and ratings,” Belarbi said.

“With the backing of these strategic investors, Cypherleak is well-positioned to continue developing cutting-edge technologies and delivering unparalleled cyber risk insights to businesses and organizations across the region and the world,” he added.

The company claims to have successfully marketed subscriptions to over 1,000 corporate clients across Europe and the Middle East and North Africa region, targeting small and medium enterprises that are frequently priced out of enterprise-grade cybersecurity solutions.

“Cyber security risks are a serious threat for MENA SMEs who are mostly unprepared to face this new reality. Thanks to their strong experience, Mohamed Belarbi and his co-founders are building a strong and user-friendly platform that is able to address these serious threats, and help MENA SMEs get insured accordingly,” Dounia Boumehdi, managing director of MITC Capital, the management company of Maroc Numeric Fund II, said.

Lars Gehrmann, chief digital officer at QIC, also stressed the importance of cybersecurity for underserved MENA SMEs.

“Cyber security is a growing topic in the MENA region. SMEs are among the companies that are the most vulnerable. Cyber insurance for SMEs is already needed and is poised to grow in the months to come,” Gehrmann added.

UAE’s fintech BILRS raises pre-seed round

UAE’s emerging fintech player, BILRS, has secured a pre-seed investment from venture capital firm Haatch, although the exact amount remains undisclosed.

Founded in 2022 by Rupert Shaw, BILRS has quickly positioned itself as a reliable facilitator, empowering both online and offline merchants to extend bill payment services to their customers.

Notably, the company claims to have customers across a portfolio of over 30 countries, showcasing the firm’s vast reach in a short span.

Millions of people in Saudi Arabia rely on Tabby today, so it’s an incredibly important step to crystalize our foundations in the Kingdom.

Hosam Arab, Tabby CEO

“We are incredibly excited about the future of BILRS and the opportunity this partnership with Haatch represents. This investment will empower us to enhance our platform’s capabilities, better serve our customers, and continue our mission of enabling purposeful remittance,” Shaw said.

“We are grateful for the confidence that Haatch has shown in our vision, and we look forward to the remarkable progress we will achieve together,” he added.

The recent funding is expected to provide BILRS with the requisite fuel to expedite its ambitious mission of introducing greater transparency and accountability into the world of money remittances.

The move aligns with the broader industry trend of leveraging fintech solutions to simplify and streamline complex financial transactions for the end-users.

Canada’s ClearPier acquires UAE’s Media Quest Group for $35m

Canadian performance advertising giant ClearPier has marked a significant milestone in its growth strategy by acquiring UAE’s Media Quest Group, also known as MQuest, in a deal valued at $35 million.

ClearPier was established in 2010 by the duo Jignesh Shah and Sunil Abraham, while MQuest was formed in 2020 by John Rowe, Jay Bhojani, and Lorraine Hall.

The latter uses data to pinpoint consumers with a notably high propensity to make purchases, acting as a conduit between advertisers and potential buyers.

The strategic move to integrate MQuest into ClearPier’s operations is anticipated to bolster ClearPier’s foothold, not just in the Gulf Cooperation Council region, but also across the European markets.