LONDON: South Africa is embarking on an ambitious economic reform agenda that shares striking similarities with Saudi Arabia’s own efforts to slash red tape and stimulate investment.

South African President Cyril Ramaphosa last month unveiled a plan aimed at helping the country recover from the impact of the coronavirus pandemic by fast-tracking projects and boosting infrastructure spending.

Like Saudi Arabia, South Africa is transitioning from a commodity-based economic foundation to a more sustainable and diversified and modernized model.

Pretoria is targeting an average annual economic growth rate of 3 percent over the next decade and has established a state infrastructure fund that will provide 100 billion rand ($6 billion) in finance, a move that the government expects will unlock a further trillion rand in investment.

The International Monetary Fund (IMF) last month maintained its forecast of an 8 percent contraction in the country’s economy this year but cut its prediction for 2021 because of the impact of the pandemic.

It now expects the economy to expand by 3 percent next year, which is 0.5 percent lower than its previous estimate.

The South African government is spending about 13.8 billion rand ($850 million) on creating 800,000 jobs and economic opportunities by the end of March next year.

An additional 86.2 billion rand will be spent on employment creation over the next two years. Just as Saudi Arabia is increasingly promoting local production and procurement, South Africa is also following a similar path to reduce its reliance on imports. Additionally, the country aims to reduce data costs and extend broadband into poor households, while a 350 rand welfare grant for those who don’t qualify for other government support will be extended by three months.

FASTFACT

$850 million

The South African government is spending about 13.8 billion rand ($850 million) on creating 800,000 jobs and economic opportunities by the end of March next year.

The measures are in a part a response to the specific strains on the South African economy that have resulted from the coronavirus pandemic.

“We expect the economy will remain subdued and for fiscal consolidation to be slow, sustaining the rise in government debt in the next couple of years,” Moody’s said in a recent report.

Trade relations between South Africa and Saudi Arabia received a boost in 2018 with an official visit by Ramaphosa to the Kingdom. The timing was significant for both countries as they stepped up efforts for radical economic transformation with a heavy emphasis on boosting private sector participation.

One area where the pair are likely to see increased cooperation is in power generation and renewables — a sector that has also been prioritized by Riyadh as it aims to reduce its reliance on hydrocarbons and develop alternative energy sources.

About 11,800 megawatts of new power generation capacity is expected to be brought on line in South Africa from 2022, more than half of which will come from renewable sources.

Independent power producers will also supply another 2,000 megawatts of power from current projects by June 2021. One such power producer that has already established a foothold in the country is Saudi Arabia’s ACWA Power, a trailblazer in developing independent power projects across the Middle East, Asia and Africa. It is the lead shareholder in the 50 megawatt Bokpoort concentrated solar power plant commissioned in 2016.

Ramaphosa is seeking to attract as much as $100 billion in investment to boost the country’s ailing economy and Saudi Arabia is seen as a potential partner in a number of planned projects in the country.

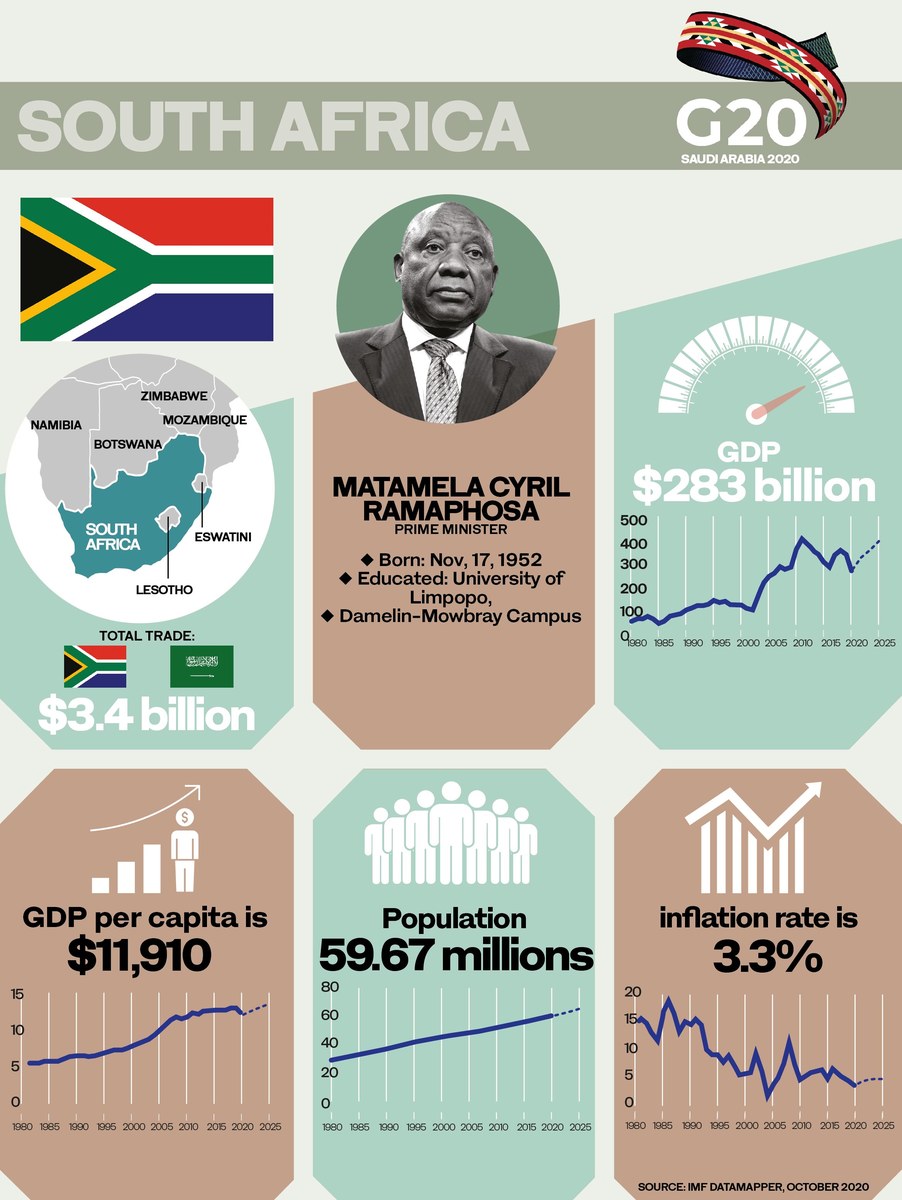

South African President Cyril Rmaphosa. (fiile photo)

The South African leader who had a strong previous career in the private sector, has promised to revive the economy and root out corruption since becoming president in February 2018. It coincided with a similar drive to stamp out corruption in Saudi Arabia as a necessary condition of instilling confidence among foreign investors.

Business confidence had been eroded substantially during the presidency of Ramaphosa’s predecessor, Jacob Zuma when South Africa’s credit rating was cut to junk by two of the big three credit ratings agencies which made it more expensive for the country to raise fresh borrowing from international investors.

The election of Ramaphosa helped to reignite international investor interest in what is now Africa’s second-largest economy behind Nigeria, but the arrival of the pandemic has been a major setback for the country where many people live in densely populated urban locations within which the virus thrives.

“The pandemic worsened an already dire situation, severely disrupting economic activity and putting numerous investments on hold,” said Ramaphosa on Tuesday.” Our priority now is driving the implementation of South Africa’s Economic Reconstruction and Recovery Plan.”

Despite the devastating impact of the pandemic on business across the entire African continent, positive signs are now starting to emerge from South African industry.

Absa Group’s Purchasing Managers’ Index, compiled by the Bureau for Economic Research, increased to 60.9 from a revised 58.5 in September, the Johannesburg-based bank said this week. It represents the first time the index has topped 60 and is the highest since record-keeping began September 1999.

The country’s employment index also rose for a fifth consecutive month — a positive sign for a country where unemployment is running at 37 percent, according to the latest data from the IMF.

The data has provided some hopes that the stimulus measures already introduced by the government are starting to produce results as the key manufacturing sector starts to recover.