BEIRUT: Auto magnate-turned-fugitive Carlos Ghosn is campaigning to clear his name, and hopes a visit by French investigators to his home in exile in Lebanon will be his first real opportunity to defend himself since the bombshell arrest that transformed him from a visionary to a prisoner overnight.

In an interview with The Associated Press, the embattled former chairman of the Renault-Nissan-Mitsubishi alliance dissected his legal troubles in Japan, France and the Netherlands, detailed how he plotted his brazen escape from Osaka, and reflected on his new reality in crisis-hit Lebanon, where he is stuck for the foreseeable future.

Mending his reputation will be an arduous task. Ghosn was arrested in Japan in November 2018 on accusations of financial misconduct and fled to Lebanon a year later. He now faces multiple legal challenges in France after the Japanese accusations triggered scrutiny of his activities there. Meanwhile, several associates are in jail or on trial in Japan and Turkey, in cases related to his financial activities or escape.

“There has been a lot of collateral damage . . . but I don’t think I’m responsible for that. The people responsible for that are the people who organized the plot” to bring him down, Ghosn said Tuesday.

Ghosn has denied accusations of underreporting his compensation and misusing company funds, contending he was the victim of a corporate coup linked to a decline in Nissan Motor Co.’s financial performance as the Japanese automaker resisted losing autonomy to French partner Renault.

He said he voluntarily agreed to undergo days of questioning in Beirut next week by French magistrates investigating allegations of financial misconduct in France that led to the seizure of millions of euros of his assets. The outcome could result in preliminary charges being handed to him or in the cases being dropped.

The French investigators are looking into the financing of lavish parties Ghosn threw at the Versailles chateau — complete with period costumes and copious Champagne — as well as €11 million in spending on private planes and events arranged by a Dutch holding company, and subsidies to a car dealership in Oman. Ghosn denies any wrongdoing.

“In Japan, you had a Japanese person interrogating me, writing in Japanese and wanting me to sign things in Japanese that I don’t understand,” he said. “Now I will be speaking in French, and I’ll have my lawyers present. Of course, I have much more confidence in the French legal system than in the Japanese system.”

Ghosn was kept in solitary confinement in Japan for months without being allowed to speak with his wife. He has said he fled the country after it became clear he would have “zero” chances of a fair trial. His arrest drew international scrutiny and criticism of Japan’s legal system and its 99 percent conviction rate.

In late 2019, Ghosn fled Japan after jumping $14 million bail in a Hollywood-style caper. The improbable escape — hidden in a box stashed in the hold of a Turkey-bound private jet, according to Japanese officials — embarrassed Japanese authorities and has allowed him to evade trial there.

Now an international fugitive on Interpol’s most-wanted list, the 67-year-old Ghosn lives in self-imposed exile in his native Lebanon, where he teaches a weekly university business course and is fighting other legal fires.

He told the AP he was “shocked” after a Dutch court last week rejected his wrongful dismissal claim against an Amsterdam-based alliance between Nissan and Mitsubishi, and ordered him to repay the nearly €5 million ($6 million) salary he received in 2018. The ruling came in a case in which Ghosn sought to have his 2018 sacking from Nissan-Mitsubishi B.V. overturned and demanded €15 million ($16.5 million) in compensation.

Ghosn has vowed to appeal.

Ghosn, who has French, Brazilian and Lebanese citizenship, contended he was the victim of a character assassination campaign led by Nissan with the complicity of the Japanese government, aided by accomplices in France.

In the AP interview, he mounted a robust defense of a former Nissan executive, American Greg Kelly, who was arrested the same day as Ghosn and is standing trial in a Tokyo District court on charges of under-reporting Ghosn’s compensation. He would not talk about two other Americans who allegedly helped him escape, Michael Taylor and his son, Peter. They are in a Japanese jail awaiting trial after their extradition from the US

Asked whether their legal troubles weighed on his conscience, Ghosn said: “I feel empathy and compassion for them, because I was in the same situation.”

Testimony and documents presented at Kelly’s trial have shown that he sought ways to beef up compensation for Ghosn after he agreed to a pay cut at Nissan in 2010, because Japan began requiring disclosures of high executive pay. Ghosn insisted Tuesday that no additional compensation agreements were approved by the board.

“Obviously he (Kelly) is innocent,” Ghosn said.

Recalling details of his escape, Ghosn told the AP how the plan was hatched, including choosing to execute it in December when he would be less likely to be recognized under a hat and heavy clothes.

“It was very bold, but because it was bold, I thought it may be successful,” he said. Ghosn refused to confirm reports he escaped in a musical instrument box, saying he didn’t want to say anything that could be used against people being prosecuted for assisting him.

Arriving in a black Nissan SUV accompanied by a bodyguard, the former high-flying executive seemed to have lost none of his swagger despite his colossal fall. He said he spends his days in Beirut preparing his legal defense, teaching, helping startups and working on his books and documentaries.

As a fugitive living in the Mediterranean country where he grew up, he said he was enjoying a slower pace devoid of jet lag, enjoying having coffee with his wife and extensive talks with his children.

That includes living in a deeply unstable country in the grips of a historic financial and economic unraveling. Ghosn said he spent six months repairing his home after it was damaged in the massive explosion at a Beirut port last summer. And like other Lebanese, he said he has a substantial amount of money stuck in the banks after authorities clamped down on dollar currency withdrawals and transfers in October 2019.

Reflecting on his downfall, he said, “It’s like you have, you know, I don’t know, a heart attack somewhere, or you’ve been hit by a bus. You change your life.”

“All of a sudden, you are in a completely different reality and you have to adapt to this reality.”

Defiant Ghosn pins hopes on French probes to clear his name

https://arab.news/9vzr9

Defiant Ghosn pins hopes on French probes to clear his name

- In an interview with The Associated Press, the embattled former chairman of the Renault-Nissan-Mitsubishi alliance dissected his legal troubles in Japan, France and the Netherlands

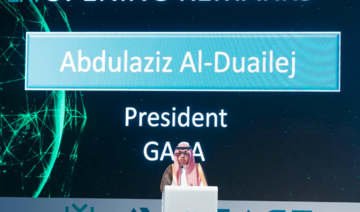

Saudi airports awarded customer experience accreditation, elevating travel services

RIYADH: Customer service offerings at 16 Saudi airports have have recognised with a prestigious global award.

The Airports Council International’s Customer Experience Accreditation for 2024 has recognised facilities operated by the Kingdom’s Cluster2 Airports Co., which include Abha International Airport, Al-Jouf Airport, and Al-Qurayyat Airport.

Additionally, they consist of Bisha Airport, Dawadmi Airport, and Hail International Airport, as well as King Abdullah bin Abdulaziz Airport, King Saud bin Abdulaziz Airport, and Najran Airport.

“This accomplishment is not merely a testament to the quality and efficiency that we deliver; it also underscores our persistent dedication to enhancing the journey of each customer who passes through our gates,” the company said in an X post.

The ACEA program assists airports in enhancing customer experience management by guiding them through a comprehensive review and training process, which emphasizes stakeholder and employee engagement, as well as staff development, according to its website.

Other airports to receive this accreditation include Prince Abdul Mohsen bin Abdulaziz International Airport, Prince Nayef bin Abdulaziz Airport, and Rafha Airport.

Moreover, they include Sharurah Airport, Taif International Airport, Turaif Airport, and Wadi Al-Dawasir Airport.

The achievement of these airbases is a testament to the robust support and consistent oversight provided by the General Authority of Civil Aviation and the company, the Saudi Press Agency reported.

These airports have been acknowledged by ACI for their ongoing commitment to delivering exceptional services for travelers.

Ali Masrahi, CEO of Cluster2 Airports Co., expressed his satisfaction with this achievement, emphasizing the company’s focus on three key areas: understanding customer needs, strategic planning tailored to traveler requirements, and continuous improvement through monitoring key performance indicators across all aspects of the passenger journey.

Accor to build 45 new hotels in Saudi Arabia by 2030: CEO

RIYADH: French multinational hospitality company Accor is set to expand its hotel portfolio in Saudi Arabia with 45 new establishments by 2030, as revealed by the regional CEO.

In an interview with Arab News, Duncan O’Rourke underscored the company’s dedication to the Kingdom’s vibrant hospitality sector and its aspirations embodied by Vision 2030.

O’Rourke said: “Saudi is an extremely important theater for us to play also because of what is happening, we are very proud to be part of this journey, this vision of 2030.”

Reflecting on the firm’s substantial presence in Saudi Arabia, O’Rourke highlighted: “Right now, we have 41 hotels in the Kingdom, and we plan to have another 45 hotels and an additional 9,800 rooms by 2030.”

Commenting on Accor’s participation in the Future Hospitality Summit, the CEO said that it aims to actively share its expertise, learn from industry peers, and collaborate on initiatives that will shape the future of the hospitality sector.

With a historical foothold in the Kingdom, the CEO reminisced: “Accor has a very long history in Saudi, a very established history.”

He added: “We are very excited to be here, me personally, having lived here 22 years ago and see the growth and the challenges.”

O’Rourke added: “One of the things we noticed tremendously was talent, and getting people to work in the hotels. Opening the hotels is one thing, but we need the local talent as well.”

He highlighted Accor’s partnership with the Ministry of Tourism and Education to nurture Saudi talent for the hospitality industry, saying: “We signed a partnership, which we were really excited about with the Minister of Tourism and Education, so we signed that partnership to be able to educate on all different levels, local people, to work in the hotels as well.”

In line with Accor’s commitment to nurturing local talent, O’Rourke explained that the firm’s academies are based worldwide and driven out of Paris, saying: “It’s been very famous how we’ve done that and trained and coached, but we felt that here with this tremendous growth in the speed of that growth and the fact that we really wanted to get local talent working.”

Diving more into the “Tamayyaz by Accor” program, the CEO explained that the educational process goes from an entry-level to a more senior position.

Accor and the Ministry of Tourism in Saudi Arabia have signed this partnership, which is dedicated to nurturing and developing Saudi talent in the hospitality industry.

O’Rourke told Arab News that they’re starting with a modest number of around 250 trainees, but that’s “quickly going to go up to over 3,000 continuously going through the process there, and so every process, 3,000 more going through.”

Expanding beyond major urban centers, O’Rourke emphasized “it’s not just in Riyadh, or in Jeddah, but in the secondary and third cities as well,” signaling Accor’s commitment to broadening its footprint across the Kingdom.

In a discussion about Accor’s varied brand lineup, he explained: “We split our luxury lifestyle, so we’re one of the largest luxury players in the market, the largest lifestyle player in the market, and then we have that premium midscale economy.”

Accor is the largest hospitality operator in the Holy Cities, with 13 hotels encompassing 11,900 rooms and a pipeline of six hotels with 1,700 rooms.

The firm has significantly contributed to developing the holy destination of Makkah, providing high-quality hospitality with direct access to the Haram.

Accor currently operates 13 brands and more than 16,000 rooms in Saudi Arabia, ranging from premium to economy segments, including luxury brands and Ennismore’s lifestyle collective. With leading names like Novotel, Swissotel, and Pullman, it’s a top hospitality provider offering diverse services and experiences.

He added: “We go with all those brands there in those resorts, not in just major cities, with Banyan Tree, Sofitel, and then, of course, Fairmont Raffles and the rest of the traditional brands as well.”

O’Rourke highlighted the necessity of employing locals, saying: “At the Novotel hotel, which we opened tonight, that’s the first female GM (general manager) in Saudi and so we are very proud of this diversification and giving opportunities to everybody there.”

The CEO added: “Being able to be part of this growth industry in terms of opening hotels, but also in educating and watching talent grow and one day moving from Saudi out and using that talent abroad, is also very exciting.”

In terms of partnerships, O’Rourke emphasized Accor’s strategic approach to collaborations that benefit both parties and local communities.

“In any partnership which we do with our core, we want somebody that embraces our values. We call them partners, we want to synergize with partners and then grow where it makes benefit for them, for us and the communities as well,” he said.

Reflecting on market trends, O’Rourke said: “Where we see the secondary cities the most traction we are in that sense there is coming from the mid-scale and the premium midscale economy,” highlighting the burgeoning demand in these segments.

“Where we do see a difference and more and more coming through is that leisure markets both locally, so Saudis traveling in Saudi, but also from the GCC coming through there,” the CEO added acknowledging the rise of leisure travel.

As Saudi Arabia continues its remarkable growth trajectory, O’Rourke expressed optimism, asserting: “We stay focused on our footprint. We have a very aggressive expansion plan to go from 44 to another 40 by 2030 is already aggressive.”

He concluded Accor’s commitment to delivering on its expansion goals while fostering talent development in the Kingdom, saying: “We continue to drive forward and make sure that we are not only opening hotels with the right brand, right partners, but then being able to really deliver on what we promised.”

Saudi banks’ funding profile changing on rising mortgage demand: S&P Global

RIYADH: Saudi banks are expected to pursue alternative funding strategies to deal with the rapid expansion in lending, fueled by the demand for new mortgages, according to S&P Global.

In its latest report, the credit-rating agency stated that the funding profiles of financial institutions in the Kingdom are set to undergo changes, primarily driven by a state-backed initiative to boost home ownership.

According to the analysis, mortgage financing represented 23.5 percent of Saudi banks’ total credit allocation at the end of 2023, compared to 12.8 percent in 2019.

“The ongoing financing needs of the Vision 2030 economic initiative and relatively sluggish deposits growth, is likely to incentivize banks to seek alternative sources of funding, including external funding,” said S&P Global.

The report also predicted that this pursuit of external funding could potentially impact the credit quality of Saudi Arabia’s banking sector.

According to the US-based rating agency, lending growth among Saudi banks has outpaced deposits, with the loan-to-deposit ratio exceeding 100 percent in 2022, up from 86 percent at the end of 2019.

S&P Global expects this trend to persist, particularly with corporate lending playing a more significant role in growth over the next few years. “We consider Saudi banks are likely to turn to alternative funding strategies to fund that expansion,” the report said.

It added: “We consider, however, that the risk created by the maturity mismatch is mitigated by the relative stability of Saudi deposits.”

The agency also predicted that Saudi banks’ foreign liabilities will continue to increase, rising from about $19.2 billion at the end of 2023 to meet the funding requirements of strong lending growth, particularly amidst lower deposit expansion.

The report highlighted that Saudi banks have already tapped international capital markets, and the credit rating agency expects this trend to continue for the next three to five years.

According to S&P Global, the Saudi banking system could transition from a net external asset position of SR42.9 billion, or 1.6 percent of lending, at the end of 2023 to a net external debt position within a few years.

In April, S&P Global, in another report, stated that banks in the Kingdom are anticipated to experience robust credit growth ranging between 8 to 9 percent in 2024.

The agency noted that this credit expansion will be propelled by corporate lending, fueled by increased economic activities driven by the Vision 2030 program.

Moreover, the report added that the Saudi government and its related entities are expected to inject deposits into the banking system, thereby supporting the credit growth of financial institutions in the Kingdom.

PIF’s tourism investment arm Asfar to develop the city of Hail as next destination, CEO reveals

RIYADH: Saudi Arabia’s northwestern city of Hail will be the fifth destination development of Saudi Tourism Investment Co., the firm’s CEO has revealed.

Speaking to Arab News on the sidelines of the Future Hospitality Summit, Fahad bin Mushayt announced the plan, which comes after the activation of the company’s projects in Al-Baha, Yanbu, Al-Ahsa, and Taif.

The projects have all been launched within one year of the Public Investment Fund-owned firm – also known as Asfar – being unveiled.

The company is mandated to invest in new projects and develop attractive travel destinations, incorporating hospitality, tourist attractions, retail, and food and beverage offerings in cities across Saudi Arabia.

Bin Mushayt said: “In almost one year, Asfar is already playing in four destinations, with Hail coming soon, so I can reveal that.”

The entity is working to bridge the gap between the public and the private sector, as well as the local community, to create unique experiences that abide by the DNA of both the nation and the cities themselves, the executive noted.

This notion came to life during the summit, where the company signed a number of agreements with hospitality developers to launch four asset classes in the city of Yanbu.

Among them, Asfar announced the signing of investment agreements with Baheej, a joint venture between the company and the Tamimi-AWN alliance, as well as the Royal Commission for Yanbu.

“This morning, we announced our partnership with Curtain Hospitality, and they are going to be the operator of our resort in Yanbu, under the brand called Cloud 7. So the structure usually involves us and the developer as an investor, and they bring the know-how to build real estate and hospitality,” he said during the second day of the event.

The concept of Yanbu as Saudi Arabia’s most up-and-coming “second-tier city” was not limited to Asfar’s CEO alone.

Speaking on a panel at the summit alongside Mushayt, Abdulrahman Al-Bassam, a board member of Baheej, further emphasized these ideas, stating: “Yanbu is going to be the gateway of the new Red Sea Riviera, with four different asset classes expected to be operational by 2027.”

Adhering to its mandate, Asfar selects a different private sector partner to develop each of their destinations, the CEO explained, saying: “We are here to empower the private sector, to encourage them, to encourage them to go and invest with us. And we give them a lot of incentives.”

He acknowledged that those companies put their money into the subsidiary. However, Mushayt emphasized that they provide “a lot of incentives” as a semi-government entity empowered by PIF, the Ministry of Tourism, and the Ministry of Investment.

The PIF subsidiary utilizes a mix of domestic and foreign investments to empower its initiatives, focusing on operators that are suitable for the needs of the project, Mushayt said.

“The operator, if it’s a hotel operator, we bring a hotel operator; if it’s an adventure park operator, we bring a theme park. In fact, we have a theme park now, and we’re talking to international operators,” he said.

The Asfar CEO further revealed that they have a resort in Yanbu that would require cruises, “so we’re talking to Cruise Saudi, and we’re talking to another international player.”

He added: “It’s a mix of foreign and local operators, investors, and our hospitality management companies.”

HR development fund helps another 74k Saudis get private sector jobs, figures show

RIYADH: Almost 74,000 Saudi nationals received help securing private sector jobs in the first quarter of 2024 by the Kingdom’s Human Resources Development Fund.

The body supported the hiring of 73,878 citizens over the period, as offering advising, training, and empowerment services to more than 1.1 million individuals.

Additionally, during the same period, the organization provided services to more than 72,000 private sector firms across various industries throughout the Kingdom. Approximately 88 percent of these establishments were small and medium-sized businesses.