DUBAI: Young Saudis eager to do their bit to transform their country into a technology hub can access a wide range of tailored initiatives by the Saudi government and local institutions.

One of them is the Entrepreneurial Emerging Leaders Acceleration Program, launched by the King Fahd University of Petroleum and Minerals Entrepreneurship Institute (KFUPM-EI) in Dhahran, Eastern Province, to drive growth in local technology-based startups.

The scheme specifically targets startups that are generating innovative products and processes in manufacturing as well as the digital economy. It aims to support Saudi Arabia’s aspiration of becoming a regional and global tech center.

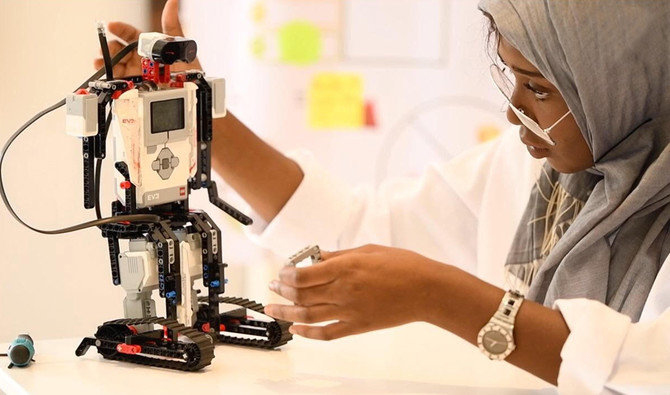

Huda Flatah launched her Helper Robot startup in 2020. (Supplied)

Huda Ahmed Flatah, 26, from Riyadh, is one of the program’s young Saudi graduates. Her startup, Helper Robot, was launched in 2020 to develop and harness technologies that provide a tangible benefit to society.

“We came up with two solutions,” Flatah told Arab News. “The first one is a robotics kit, including sensors, motors and an electrical circuit, for anyone who wants to build a prototype. It’s easy to use and connect, and you can use it if you are looking to build a smart home or a smart car.”

The second product her firm created is an online platform for people looking to study science, technology, engineering and mathematics subjects, allowing them to take part in classes in programming, electrical circuits and robotics.

Flatah was among the first batch of women to study at KFUPM-EI. Having already earned a degree in biology from Taibah University in Madinah, she went on to receive a scholarship to study at Draper University in California’s Silicon Valley and at H-FARM College in Italy, where she pursued studies in entrepreneurship and technology.

Huda Flatah receiving an entrepreneurship certificate from Global Entrepreneurship network. (Supplied)

Flatah is grateful for the scholarships and acceleration programs the Kingdom has on offer to help young people break into the tech industry.

“It was really great because when you see your country and institution care about your project, and help and believe in you. It helped me a lot, especially during the COVID-19 pandemic,” Flatah said. “It was so difficult, but we made it.”

Moreover, she is impressed by the Kingdom’s efforts to encourage more women to take up STEM subjects and career paths. She says the program has been both character-building and a boost to her self-esteem — essential in what is otherwise a male-dominated field.

A growing awareness of the need to diversify the Kingdom’s economy away from oil into other high-value industries prompted the launch of the Vision 2030 reform agenda in 2017. One of the objectives of the program is technological development, primarily driven by domestic startups.

Saudis attend a hackathon in 2018 to explore high-tech solutions to make Hajj pilgrimage more efficient and safe. (AFP)

“We are seeing a lot of opportunities today across the Kingdom for those who are ready,” said Flatah. “We have Vision 2030 for the dreamers and workers, and those who want to make a big change and improve our lives. Each university and school is looking for entrepreneurs.

“I have a vision for myself, and we want to build a generation of builders and innovators. I need to make this jump and change myself.”

Earlier this year, Saudi Arabia announced it would invest more than $6.5 billion in future technologies and entrepreneurship to further secure its position as the region’s largest digital economy.

As part of the announcement, Saudi and foreign firms unveiled plans that included a billion-dollar investment from NEOM Tech & Digital Company to focus on future technologies, such as XVRS, the world’s first cognitive metaverse, and M3LD, a personal data management platform.

Waiter robot Mediaf. (Supplied)

XVRS is a first-of-a-kind 3D, cognitive digital twin metaverse platform, where the physical merges with the virtual to create unique, immersive experiences and enable a ground-breaking “mixed-reality” urban living model.

For example, NEOM visitors and residents could attend a meeting wherever they are, either as a real-life robot, an augmented reality avatar or as a hologram.

“The future will be defined not by megacities, but by cognitive metacities,” Joseph Bradley, CEO of NEOM Tech & Digital Company, told delegates at Saudi Arabia’s flagship technology event, LEAP, in February.

Joseph Bradley, CEO of NEOM Tech & Digital Company. (Supplied)

“XVRS is the only iteration of the metaverse currently in development that will be a mixed-reality, 3D digital twin of a physical place — in our case, the NEOM community. It will be comprised of next-generation digital assets that users can interact with in the real world.”

M3LD, meanwhile, is an innovative artificial intelligence-driven “consent management platform,” which empowers users to regain control of their data.

FASTFACTS

XVRS is a 3D, cognitive digital twin metaverse platform which can create unique, immersive experiences.

M3LD is an AI-driven platform that empowers users to regain control of their data.

The product is able to find out who is in possession of a user’s data, monitor how it is being used and provide recommendations on privacy settings for all their digital accounts. It is slated for general release in the first quarter of 2023.

It is through schemes like the Entrepreneurial Emerging Leaders Acceleration Program at KFPUM-EI that the Kingdom hopes to tap and develop local talent to drive forward the “fourth industrial revolution” and realize the full potential of projects like NEOM.

Graduates of the KFPUM-EI leaders acceleration program display their certificates. (Supplied)

Meem Web Solutions is another tech venture that came out of the KFPUM-EI program, offering a platform that optimizes business process automation.

Its founder, Syed Shamaail Jafri, received a grant of SR50,000 ($13,300) from the institute’s Keys of Goodness fund. Jafri says his idea stemmed from his initial recruitment by the institute to automate one of its processes.

“I thought it would be better to make an application that can be generalized to automate all these processes,” Jafri told Arab News.

“Now, any person without any programming knowledge can develop such workflows, and we’re targeting markets that do not have any business developers and have a lot of processes which are not automated. In that regard, we just make their offices paperless.”

Originally from Pakistan, 42-year-old Jafri says he is grateful for the backing of the Saudi government to develop his business.

“My goal for the future is to establish this company independently,” he said. “The institute really helped me in the legal aspects, and I hope to serve all companies here in Saudi Arabia and then worldwide.”

KFPUM founding dean Wael A. Mousa. (Supplied)

High-growth startups such as these will have a vital role to play in the diversification of the Kingdom’s economy, says Wail A. Mousa, an associate professor of electrical engineering and founding dean of the Entrepreneurship Institute.

“We see a strong and ever-increasing entrepreneurial spirit across our community,” Mousa told Arab News.

“Through our programs, we aim to nurture this spirit and to provide the practical support required to establish and build these businesses, to reach their full potential and to make a lasting contribution to the country’s economic prosperity.”

The institute was established to help foster entrepreneurial thinking through education, training and research, and to provide logistical and financial support for the formation and growth of high-potential startups. It also draws on the expertise of local and international experts.

To date, KFUPM-EI has conducted more than 4,000 mentoring sessions, trained more than 2,000 participants, and created more than 30 startups that have resulted in more than 100 jobs and secured SR25 million in revenues.

Saudis attend a hackathon in 2018 to explore high-tech solutions to make Hajj pilgrimage more efficient and safe. (AFP)

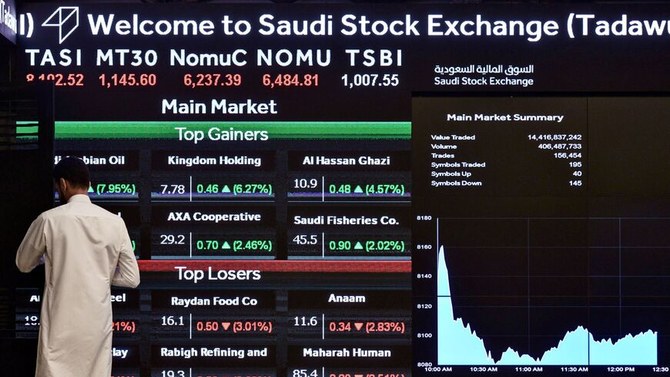

These efforts to promote entrepreneurship seem to be paying off already. Venture capital investment in Saudi Arabia in 2021 exceeded the total for 2019 and 2020 combined.

According to Abdullah Al-Swaha, minister of communications and information technology, Saudi Arabia is now home to some of the region’s largest investments in cloud technology, with leading hyperscale cloud providers including Google, Alibaba, Oracle and SAP investing more than $2.5 billion in the Kingdom.

Speaking at LEAP earlier this year, Al-Swaha said that Saudi Arabia is also the regional leader for technology talent, having created more than 318,000 jobs in the sector in recent years.

More importantly from the standpoint of women’s empowerment, the rate of women’s participation in the information and communication technology workforce has jumped to 28 percent in recent years.

“Technology is important because it’s the future,” said KFUPM-EI graduate Flatah.

“The transformation taking place across Saudi Arabia from sector to sector involves technology, so if you don’t invest in technology, you may fail in the next 10 years, because it won’t fit the requirements of the generation.”