DUBAI: March 2020 will go down in oil history as the month that changed the energy world.

What seemed to be certainties at the beginning of the month — growing demand for energy products, reasonably stable oil prices, business-like alliances in the crude markets — have all been upended. The industry will never be the same again.

Daniel Yergin, the pre-eminent historian of the oil industry, described the past month as “unlike anything in the history of the oil industry,” as the world has locked itself down in the face of the outbreak of the coronavirus disease (COVID-19).

Measures taken against the virus have affected the economy of virtually every country on earth.

FASTFACTS

20%

Contraction in global oil demand

Goldman Sachs, the US investment bank, estimated in a recent research paper that 92 percent of global gross domestic product (GDP) had been impacted by social-distancing measures.

The fossil fuel industry will inevitably feel the pain more acutely than other economic sectors.

“Not only is this the largest economic shock of our lifetimes, but carbon-based industries like oil sit in the cross-hairs, as they have historically served as the cornerstone of social interactions and globalization — the prevention of which are the main defense against the virus,” Goldman said.

These measures have led to a contraction of global demand of at least 20 percent, as factories fall idle, trucks stop hauling and planes are grounded. Some experts believe the demand loss will be even greater as the virus peaks in Europe and the US.

But what made this unprecedented health crisis all the more problematic for oil producers were the events of March 6 in Vienna.

There the three-year old pact between the Organization of Petroleum Exporting Countries and non-OPEC producers — led respectively by Saudi Arabia and Russia, known as OPEC+ — fell apart over Saudi proposals to deepen and prolong output cuts in order to prop up the price of crude.

Some commentators at the time thought the Saudis were bluffing, and had “painted themselves into a corner,” but they were given reason for second thoughts a few days later when the Kingdom unveiled a “shock and awe” campaign to dramatically increase output and offer big discounts to global customers.

“They mean it,” one expert tweeted.

Since then, Saudi Arabia has relentlessly upped the stakes.

The Kingdom announced it intended to increase its “maximum sustainable capacity” — the amount of all the oil it can produce at full-out capacity — to 13 million barrels per day (bpd) in the long term. Just this week it said it would increase exports to an unprecedented 10.6 million bpd from next month.

Other big producing countries like Russia, the UAE, Iraq and Nigeria said they would also increase output dramatically — though none have the same capacity as Saudi Arabia, with its easily accessible fields and low production costs.

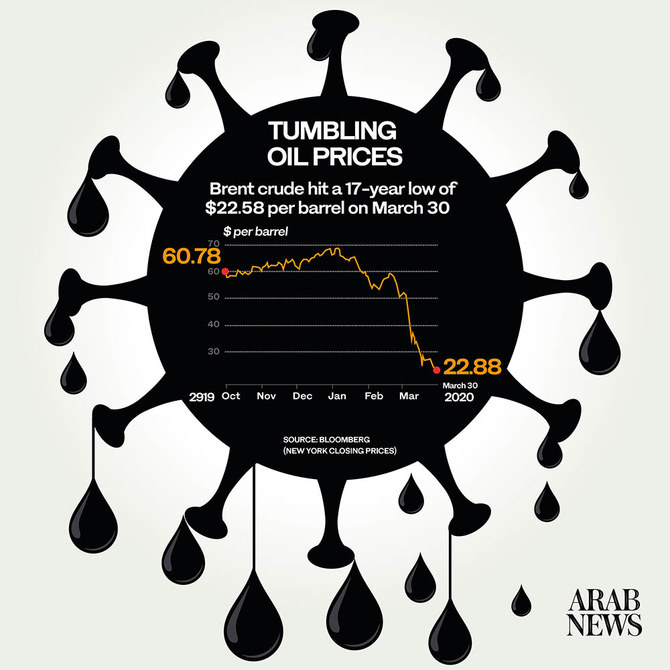

The immediate effect was been the sharpest fall of the price of crude in decades.

In the last three weeks Brent crude has halved in price, and is standing at around one-third of its average price over the past year.

On March 9 — the first day trading after the Vienna collapse — it fell by 30 percent, the biggest one-day amount in 30 years.

This shock has sent convulsions through the global oil industry.

Refineries, pipeline and storage facilities are awash with crude; the maritime crude carriers that can store crude on the high seas have been rented out for the duration at big premiums.

In some landlocked American oilfields — where production costs are much higher than in Saudi Arabia — it has been reported that producers are paying customers to take crude away, rather than charging them for the goods supplied.

In an era when negative interest rates loom larger each day, we now have “negative oil.”

The fossil fuel industry will inevitably feel the pain from the coronavirus impact more acutely than other economic sectors. (Reuters)

Goldman Sachs estimated that the world has spare storage capacity for around 1 billion barrels of oil but not all of that will be accessed because transportation systems — pipelines, haulage and shipping — will seize up first.

What remains open will be quickly swamped if there are 20 million surplus barrels being produced per day, as Goldman estimates.

The unavoidable fate for some oil fields will be to “shut in” — to physically stop producing and leave the oil in the ground as long as prices stay so low. But this option is fraught with risks too.

Oil corporations and governments need the revenue from crude sales, and their reserves could deteriorate quickly and their wells suffer serious long-term damage.

The other negative effect of full storage tanks for some parts of the industry is that, once economies restart and oil demand eventually picks up, there will be a glut of cheap oil ready to flood the world’s markets, further endangering the high-cost producers’ hopes of recovery.

Another set of US experts, the energy research team Bank of America Merrill Lynch, summed up the prospects in the three-word headline of a research note: “Into the Abyss.”

Against this background, many industry experts have struggled to understand why Saudi Arabia effectively declared “oil price wars” once the Russians refused to get involved in deeper cuts in Vienna.

Some have highlighted the destabilizing effect on the global energy industry which the Kingdom has long sought to stabilize.

FASTFACT

30%

Drop in price of crude on March 9

Others have pointed to the undoubtedly negative effects of “price wars” on the Kingdom’s own revenues from oil, which are significantly impacted by lower oil prices, even if securing a bigger long-term market share.

The complaints about Saudi Arabia’s new initiative have reached a crescendo in the US, which has by far the most to lose from a prolonged price war.

American senators from oil-producing states have written strongly worded letters to US President Donald Trump demanding action against their ally.

But the Kingdom has stuck resolutely to its position: Its deal with the Russians stabilized the industry for three full years, even as other producers were honoring it only in word.

The US shale industry got a very good deal out of the OPEC+ arrangement for a long time and should be grateful for that; and it was the Russians, rather than the Saudis, who precipitated the current situation.

Many experts are beginning to agree with the Kingdom. Omar Najia, head of derivatives at global trading group BB Energy, said: “Shale has been sick for so long and has been having a free ride on the back of OPEC+ for so long, the shoe had to drop.”

Against the charge of recklessness leveled against the Kingdom and Russia for starting the price war, some experts are beginning to discern a pretty shrewd long-term strategy.

Writing in the Financial Times, Antoine Halff, research scholar at the Columbia University Center on Global Energy Policy in New York, said; “From a game theory perspective, it is a masterstroke.”

He argued the real target of the strategy is the US shale industry, which has thrived on prices kept artificially high by OPEC+.

“The sell-off will hurt producers all around but will bring Riyadh and Moscow longer term benefits. The real prize for OPEC is the taming of shale oil,” Halff said.

While the US share industry was aware of the danger from March 6, with dire noises immediately coming from Texas, home of the US oil industry, about the financial dangers, it has taken longer for policymakers to react.

Trump, caught in an election cycle with gas-consuming voters and oil-producing supporters to satisfy at the same time, initially said falling oil prices were “good for the consumer,” but recently changed his mind as the oil lobby has increasingly got its point across.

“I never thought that I’d be saying that maybe we need to have an oil increase, because we do. The price is too low,” Trump said, before talking to Russian President Vladimir Putin about oil and agreeing ministerial level talks about the possibility of some kind of stabilization.

Yergin told Arab News: “Trump has now engaged directly with the crisis in the oil industry. The administration is very concerned about the price collapse and its threat to the future of the US oil and gas industry.

“And it’s not just the administration. It’s also some of the most influential and important US senators who have become alarmed about the impact on their states.”

Trump has also named a special oil envoy, Victoria Coates, former adviser to US Energy Minister Dan Brouillette, to handle US-Saudi oil relations, raising hopes that a three-way pact between the US, Russia and Saudi Arabia — a kind of super-OPEC+ — might be a possibility.

Some oil experts do not share that optimism. Robin Mills, chief executive of consultancy Qamar Energy, said: “It’s hard to see there would be a deal. Co-ordinating US producers and getting them to co-operate with Russia and Saudi Arabia is problematic, and it is all politically difficult for Trump.”

But it is also hard to see any deal on oil output that could outweigh the dramatic destruction of oil demand that has taken place in the past few weeks because of the virus lockdown.

The month of March has transformed the economics, dynamics and power relationships of the oil industry, and it is hard to see how the old certainties can ever return.