BANGKOK: Three journalists from military-ruled Myanmar who were convicted of illegal entry after they fled to Thailand have been sent to a third country where they are safe, their employer said Monday.

The three staff members of the Democratic Voice of Burma, better known as DVB, were arrested on May 9 in the northern Thai province of Chiang Mai along with two other people from Myanmar described as activists. On May 28, they were each sentenced to a 4,000 baht ($128) fine and seven months’ imprisonment, suspended for a year.

Rights groups and journalists’ associations had urged Thai authorities not to send them back to Myanmar, where it was feared that their safety would be at risk from the authorities. Thailand’s government has relatively cordial relations with Myanmar’s military regime.

Myanmar’s junta seized power in February by ousting the elected government of Aung San Suu Kyi, and has attempted to crush widespread opposition to its takeover with a brutal crackdown that has left hundreds dead. It has tried to silence independent news media by withdrawing their licenses and by arresting journalists.

All five people convicted in Chiang Mai of illegal entry left Thailand recently for the third country, Aye Chan Naing, DVB’s executive director and chief editor, said in an emailed statement. He said, without elaborating, that he could not mention where they had been sent “as the entire case remains very sensitive.”

He expressed gratitude to “everyone in Thailand and around the world that helped to make their safe passage possible and for campaigning for a positive outcome,” and said the employees would resume their duties in the near future after “recovering from their ordeal.”

According to Myanmar’s Assistance Association for Political Prisoners, about 90 journalists have been arrested since the takeover, with more than half still in detention, and 33 in hiding. Those still being held include two UScitizens, Danny Fenster and Nathan Maung, who worked for Myanmar media.

At least two other DVB journalists have been sentenced to prison for their reporting. DVB, an independent broadcast and online news agency, was among five local media outlets that were banned in March from broadcasting or publishing after their licenses were canceled. Like other banned media outlets, it continued operating.

Journalists who fled Myanmar find third-country refuge

https://arab.news/gfsrj

Journalists who fled Myanmar find third-country refuge

- The three journalists of the Democratic Voice of Burma were arrested on May 9 in Chiang Mai

- On May 28 they were each fined $128 and handed seven-month suspended imprisonments

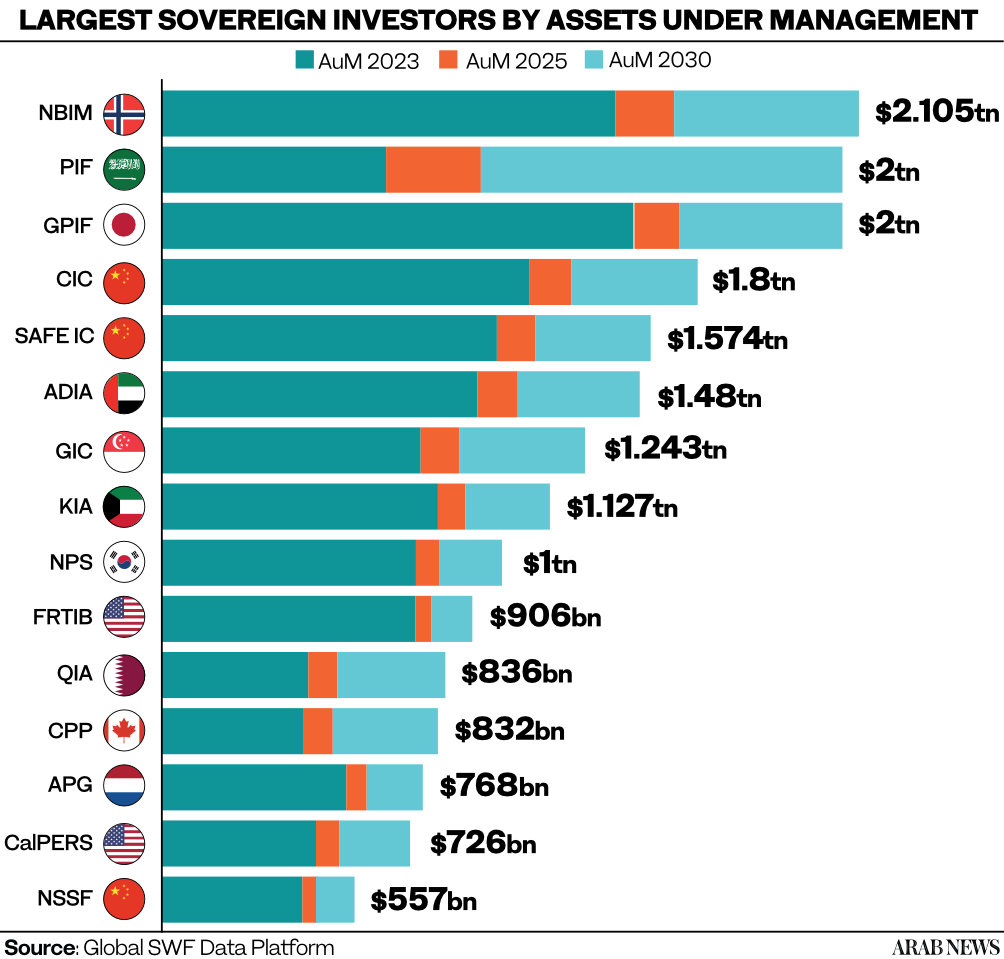

PIF set to have $2 trillion in assets under management by 2030: report

- In March 2024, PIF’s assets under management surpassed $925 billion, up from $700 billion at the end of 2022

RIYADH: Saudi Arabia’s Public Investment Fund is poised to reach $2 trillion in assets under management by 2030, propelling it from 5th to 2nd place globally among sovereign wealth bodies, according to Global SWF.

The organization that monitors activity in this area stated that the PIF’s rapid ascent can be attributed to the fund’s focus on direct investments, emphasis on key sectors of the Saudi economy, dedication to sustainability through leading investments in renewables and green assets, and active participation in the digital economy.

The institute’s 2024 annual report disclosed that in 2023, PIF took the lead as the top investor among all sovereign wealth funds, allocating $31.6 billion across 49 deals – a 33 percent increase from the prior year.

This progress elevated the fund by 10 positions between global sovereign investors in new capital deployed within a mere three years.

In just eight years since its restructuring, the Saudi fund has become a dominant force both domestically and internationally, with the aim of advancing Vision 2030 and achieving the status of the world’s largest sovereign wealth fund by the end of the decade.

In March 2024, PIF’s assets under management surpassed $925 billion, up from $700 billion at the end of 2022, securing its position as the fifth largest global sovereign wealth fund, after the government transferred an additional 8 percent stake in Aramco to its portfolio.

The fund strategically delved into co-investments and forged joint ventures to bolster Saudi Arabia’s drive for economic diversification.

Noteworthy examples include partnerships with mining giant Ma’aden, tire makers Pirelli, and car manufacturer Hyundai.

This was alongside an agreement with Baosteel and Aramco for the construction of a steel mill.

The report highlighted that unlike numerous sovereign wealth funds that frequently choose co-investing as their primary strategy, both globally and in the Gulf region, PIF stands out with a strong preference for direct investments in private equity.

Specifically, it targets critical sectors of the Saudi economy, including sports and leisure, tourism, and gaming, as well as construction, and heavy industry.

Despite the clear advantages that co-investing offers – such as enhanced due diligence, favorable fee terms, and portfolio diversification – some sovereign investors may shy away due to concerns about deal visibility and relinquishing transaction control to other government funds.

According to the report, PIF stood out from other funds due to its substantial domestic investments, which significantly impacted its international investment capacity relative to other funds.

In 2023, Saudi Arabia’s sovereign wealth fund saw an 18 percent growth in its US equities portfolio, driven by rising stock values.

PIF maintained a passive approach, keeping major positions unchanged.

According to the report, its largest holding remained a 63 percent stake in Lucid Motors.

PIF initiated its investment of $1 billion in the electric vehicle rival to Tesla back in 2018, and following Lucid’s initial public offering three years later has continued to infuse capital into the company.

This included an injection of $2 billion in June 2023, and Lucid is on course to commence EV production in Saudi Arabia by 2025.

PIF’s US-listed portfolio includes $8.1 billion in gaming companies such as Activision Blizzard, Electronic Arts, and Take-Two, reflecting the Kingdom’s plan to invest $38 billion to become a hub for this sector as part of Vision 2030.

In its report, Global SWF discussed the challenges encountered by sovereign investors in recent years and the corresponding solutions they implemented in 2023 to enhance the resilience of their portfolios.

One significant challenge involved addressing the decarbonization of the global economy. This was tackled through the introduction of a new sustainable investment strategy, shedding light on “climate alpha.” This typically refers to investments or strategies that aim to address global warming and its associated risks and opportunities.

This could include investments in companies or projects that are focused on renewable energy and efficiency, sustainable agriculture, clean transportation, and other environmentally friendly initiatives.

Sovereign investors showcased their dedication to sustainability during COP28, highlighted by the UAE’s launch of a $30 billion climate-focused fund, supported by BlackRock and fellow state-backed wealth funds. The goal is to access these areas while also greening existing black assets through de-carbonization.

Meanwhile, Saudi Arabia has taken a leading role in direct investments within the EV and automotive sectors. As well as its stake in Lucid, the Kingdom launched its own EV carmaker, Ceer, in a joint venture with Taiwan’s Foxconn.

Further partnerships include collaborations with Tasaru for component localization, Hyundai for a car plant, and Pirelli for tire manufacturing.

According to Global SWF, sovereign investors directed a record $26.1 billion towards green assets in 2023, prioritizing investments in the energy transition, including renewables, battery storage, and EVs.

Gulf sovereign wealth funds contributed nearly half of this sum, leading the charge in driving the energy transition agenda.

The report also underscored another challenge encountered by sovereign funds, which is market volatility and the risks stemming from geo-economic fragmentation.

To tackle this issue, fund investors have embraced a more comprehensive total portfolio strategy. This strategy integrates alpha and beta return drivers, merging top-down and bottom-up analyses, with a significant emphasis on diversification.

By adopting this holistic approach, investors gain a thorough understanding of their investments, facilitating more informed decision-making, enhanced risk management, and the opportunity to optimize portfolio performance by focusing on the unique attributes and dynamics of each component within the portfolio.

The rise of disruptive artificial intelligence was also addressed in the report, which noted it represents a significant risk for sovereign investors as it can lead to rapid changes in industries, markets, and investment landscapes.

AI-powered technologies can impact traditional business models, alter consumer behavior, and introduce new competitive dynamics. To address this challenge, one proposed solution by sovereign investors is to integrate AI-powered portfolios into their investment strategies.

By incorporating AI technologies into portfolio management, sovereign funds can leverage advanced algorithms and data analytics to gain valuable insights.

AI-powered portfolios can analyze vast amounts of data in real-time, identifying trends, patterns, and market signals that may not be immediately apparent to human analysts. This can lead to more accurate risk assessments, better market timing, and enhanced investment decision-making.

Additionally, AI can enable sovereign investors to automate certain aspects of portfolio management, such as rebalancing, trade execution, and risk monitoring. This not only increases operational efficiency but also allows for more agile responses to changing market conditions.

According to the report, 2023 saw sovereign wealth funds adjusting their real estate investments amidst concerns of global interest rate hikes and a potential property bubble.

Despite an overall softening in the market, some segments, such as data centers and affordable housing, saw growth as fund investors aligned with emerging megatrends. Data center investments surged by 150 percent to $7.6 billion in 2023, indicating a strong focus on future-oriented assets.

This shift reflects a move from traditional investments to a more sophisticated strategy, exemplified by PIF’s forming partnerships to develop data centers.

The report flagged up that in 2023, the GCC region – led by the Abu Dhabi Investment Authority, Abu Dhabi’s Mubadala, ADQ, PIF, and the Qatar Investment Authority – saw a record surge in sovereign capital to $4.1 trillion in assets under management, with transactions totaling $82.3 billion.

Projections indicate these sovereign wealth funds could reach $7.6 trillion in assets by 2030. This growth, according to the report, is fueled by high oil prices and a maturing investment landscape, driving economic diversification with growth forecasts of 3.6 percent and 3.7 percent for GCC nations in 2024 and 2025.

In this region, two distinctive sovereign wealth fund management approaches were highlighted by Global SWF.

Abu Dhabi’s strategy involves the establishment of multiple SWFs, each with specific missions overseen by different royals. Saudi Arabia, on the other hand, centralizes its investment and strategic efforts under PIF, aligned with the government’s overarching vision.

Further, its leaders have no problems in announcing grand plans for the fund, using it in its name to buy football clubs or golf leagues, and in sharing its finances publicly given its fundraising efforts, in a rather refreshing fashion, the report said.

The institute presented updated projections in the State-Owned Investors 2030 section, factoring in the industry’s recovery in assets under management in 2023.

It anticipates that public pension funds and central banks will reach $54.9 trillion by 2025 and $71 trillion by 2030. By then, Norway’s Norges Bank Investment Management, Saudi’s PIF, and Japan’s Government Pension Investment Fund could lead the table with over $2 trillion in assets under management each.

Iran to release crew members of seized Portugal-flagged ship

- The ship’s seizure took place hours before Iran carried out its first-ever direct attack on Israel, launching hundreds of drones and missiles

TEHRAN: Iran said on Saturday it would release the crew members of a Portuguese-flagged ship that its forces seized this month in the Gulf.

The Revolutionary Guard Corps took over the MSC Aries with 25 crew members on board near the Strait of Hormuz on April 13.

Tehran later said the ship belonged to its Israel and was being investigated for alleged violations of international maritime law.

“The humanitarian issue of the release of the ship’s crew is of great concern to us,” Iran’s Foreign Minister Hossein Amir-Abdollahian said in a phone call with his Portuguese counterpart Paulo Rangel.

BACKGROUND

The ship’s seizure took place hours before Iran carried out its first-ever direct attack on Israel, launching hundreds of drones and missiles.

“We have given consular access to their ambassadors in Tehran and announced to the envoys that the crew members will be released and extradited,” he was quoted as saying in a statement from his ministry, without elaborating.

Following the ship’s seizure, Portugal summoned Iran’s ambassador to demand its immediate release.

On April 18, India said one of the 17 Indian crew members had returned home and that the others were granted consular access.

“They are in good health and not facing any problems on the ship. As for their return, some technicalities are involved,” an Indian Foreign Ministry spokesman said on Thursday.

The ship’s seizure took place hours before Iran carried out its first-ever direct attack on Israel, launching hundreds of drones and missiles.

The Israeli military said nearly all of the projectiles were intercepted.

Israel and the US have denounced the seizure of the ship as an act of “piracy.”

Regional tensions have soared since war broke out nearly seven months ago between Israel and Palestinian militant group Hamas in the Gaza Strip.

‘World has never seen such a rapid increase in hunger,’ WFP regional director Corinne Fleischer tells Arab News

- Overlapping conflicts and residual pandemic effects have forced World Food Programme to reduce assistance, says top aid official

- Says Palestine, Ukraine, Yemen, Sudan and South Sudan stand to benefit from $10 million contribution by Saudi Arabia’s KSrelief

DUBAI: With budgets squeezed by rising prices and limited donations, humanitarian agencies are struggling to respond to the world’s multiple, overlapping crises, contributing to a rise in malnutrition, a top aid official has warned.

Corinne Fleischer, the World Food Programme’s regional director for the Middle East, North Africa and Eastern Europe, said that her agency had been forced to reduce its assistance to communities in several crisis contexts.

“This is due to conflicts, the impact of COVID-19, and the impact the Ukraine war has on food prices,” Fleischer told Arab News in an interview in Dubai. “Hunger is going up and governments are now looking at their own economies and needs.

“The humanitarian system is really challenged. It is a dramatic situation.”

Fleischer, who recently held a meeting in Egypt with Dr. Abdullah Al-Rabeeah, supervisor-general of the King Salman Humanitarian Aid and Relief Center (KSrelief), said that WFP was very pleased to have strengthened its relationship with the Saudi aid agency.

“We signed an agreement where KSrelief will provide $10 million for our operations in Ukraine, $5 million for Palestine, $4.85 million to Yemen, and $1.4 million for Sudan and South Sudan,” she said.

“The focus of these contributions is of course saving lives and providing nutrition with a focus on mothers, pregnant and nursing mothers and young children under two.”

This additional financial assistance could prove lifesaving for the population of Gaza, which has endured months under Israeli siege.

More than six months after Israel launched its military offensive and placed tight restrictions on the flow of commercial goods and humanitarian aid permitted to enter the Palestinian enclave, the population has been brought to the brink of famine.

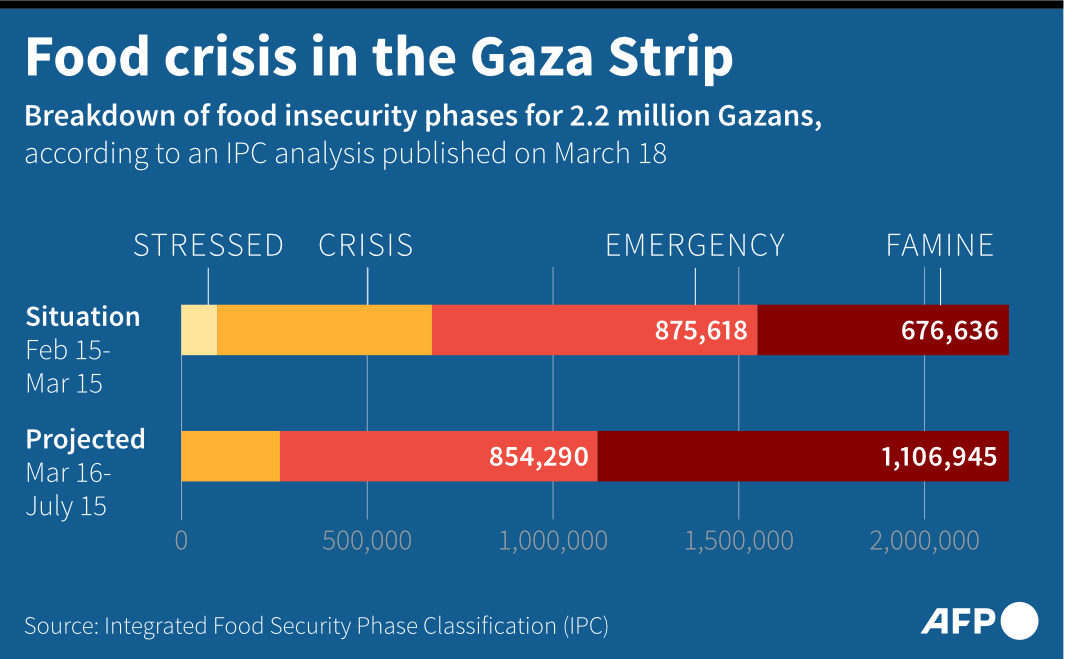

“I have never seen, even the world has never seen, such a rapid increase in hunger, where now 50 percent of the population is starving,” Fleischer said.

According to WFP figures, 0.8 percent of Gazan children were categorized as malnourished prior to the war. Just three months into the conflict, that number rose to 15 percent. A further two months later, it rose to 30 percent.

“From the beginning, we knew where the conflict might go, so we made sure we have enough food at the borders for 2.2 million people to be able to move in as soon as we can,” Fleischer said.

INNUMBERS

• 1.1 million Gazans experiencing catastrophic hunger — a number that has doubled in just 3 months.

• 1/3 Sudanese — 18 million people — facing acute or emergency food insecurity 1 year into the conflict.

• 900,000 Syrian refugees in Lebanon that WFP provided with food and other basic needs in February alone.

Although WFP continues to bring aid deliveries into Gaza, the number of trucks allowed in is far too limited to meet the needs of the stricken population. Some 500 trucks were entering the enclave prior to the war. Now barely 100 are permitted to enter — at a time when needs are at their greatest.

“We use the Rafah corridor, the Jordan corridor, which we’ve also set up, but the aid from there goes through Kerem Shalom and this is where the choke point is,” Fleischer said.

Kerem Shalom, which used to be the main commercial crossing between Israel and Gaza, has been repeatedly blocked by Israeli protesters demanding the release of hostages.

WFP has called on Israel to open more crossing points and is now able to go through the Erez Crossing. According to Fleischer, this has allowed aid agencies to access communities in the north of Gaza, where famine is taking hold.

“We managed in the last month to bring food for about 350,000 people,” she said. “That is not enough for a whole month, but it’s a start.”

Fleischer said that it was a good sign that they were now able to use other road routes within Gaza to distribute aid, such as the Salah Al-Din Road, the main highway of the Gaza Strip, where WFP now sends regular convoys, and the Port of Ashdod, one of Israel’s three main cargo ports.

“We are now able to send wheat, flour and other foods, and that is hugely important,” Fleischer said. “Ashdod is a functioning port. It will be able to get us directly into Gaza and into its north.

“While the signs are good now that more openings are being provided, it needs to be sustained. We still have famine on our watch from the six months of not being able to send in any aid, and let me tell you what that means besides giving statistical numbers.

“When we come with our trucks, people jump on them. Not only that, they open the boxes, they take the food and eat it first before they take the rest to their families. Can you imagine how hungry they are?

“That is disastrous and so we need to be able to bring this down, to give confidence to people that food is coming on a daily basis so they also are not attacking our trucks. We need this to be sustained at a much larger scale. There are 2.2 million people in Gaza that need food.”

Fleischer said that private businesses such as bakeries must also be restored and reopened, as humanitarian agencies alone will not be able to sustain Gaza for the entirety of the conflict should it continue. WFP assistance has helped 16 to reopen.

“We are now restoring bakeries,” she said. “In the north, people haven’t eaten bread for a long time, and because we are able to go there currently, we are bringing fuel to bakeries as well as wheat, flour, yeast and sugar. So they’ve started operating again.

“We also have contacts with retail shops that we used before the war. Now we are working with them, we bring them our food and the parcels that we provide, and they distribute it, so they stay alive, they keep their workers, they open every day. So as soon as commercial food comes in again, they are ready.”

WFP has been touted as a potential replacement for the UN Relief and Works Agency as the primary aid agency working in Gaza after Israel raised allegations in January suggesting UNRWA staff had participated in the Hamas-led attack of Oct. 7, leading several donor nations to suspend funding pending an investigation.

“We cannot replace UNRWA. That is very clear,” Fleischer said. “UNRWA does much more than bring food to people. We are distributing food in camps that are managed by UNRWA. It needs to stay. That is very clear.”

Gaza is not the only hunger hotspot in the region, nor the only one that has seen the provision of aid by WFP dwindle owing to funding constraints — the worst the agency has experienced in 60 years.

These budget cuts have raised concerns among refugee host countries such as Jordan and Lebanon about the continuation of assistance. “This can really impact stability and what it means for the region,” Fleischer said.

“Syria is no longer at the top of the list now. Two years ago it was. But then came the Ukraine war and now we have Gaza. Do you know how this translates in terms of the assistance we provide to Syrians? We are the safety net for them. They don’t get much subsidies.

“We went from supporting six million people every month with food to three, to now one million within seven months because of lack of funding. The situation is desperate. And now you also see malnutrition rates going up there.

“I can tell you in Syria, when we announced those cuts, we had weapons at our distribution points, people were so desperate. We also reduced up to 40 percent of aid to refugees in Lebanon.”

And it is not just displaced communities that the agency has to support. Fleischer said that the number of Lebanese citizens requiring aid had also risen dramatically due to the country’s grinding financial crisis.

Fleischer said that WFP has been able to work with the Lebanese government and the World Bank to gradually integrate those citizens to receive state welfare.

In the south, however, where Israel and Lebanon’s Hezbollah militia have traded fire along the shared border since the conflict began in Gaza, the situation is different.

“We have supported 62,000 people,” said Fleischer, referring to the communities displaced by the cross-border exchanges. “These are both Lebanese citizens and Syrian refugees who have been impacted by the tensions in the south of Lebanon.

“However, if it escalates, the UN and the humanitarian sector will not be able to handle it at this rate. It will exceed the funding and assistance capacity.”

Last-gasp goal stretches Leverkusen unbeaten streak

- The strike keeps Leverkusen’s remarkable streak of late goals alive

- Alonso’s side have now won or equalized in stoppage time 10 times this season in all competitions

LEVERKUSEN, Germany: Robert Andrich scored with the last kick of the match to extend Bayer Leverkusen’s unbeaten run to 46 games this season with a 2-2 home draw against Stuttgart on Saturday.

With Bundesliga champions Leverkusen facing their first loss of the season in any competition trailing 2-1 late in stoppage time, Andrich hammered in a loose ball to equalize in the sixth minute of stoppage time.

The strike keeps Leverkusen’s remarkable streak of late goals alive, with Xabi Alonso’s side doing the same at Borussia Dortmund in the seventh minute of injury time for a 1-1 draw last week.

Two goals in the space of nine minutes to start the second half from Chris Fuehrich and Deniz Undav put Stuttgart on course, with Amine Adli pulling one back after 61 minutes.

Leverkusen built pressure but could not break through, putting their hopes of becoming the first team to go a full Bundesliga season without defeat in doubt.

However, with time running out, they won a free kick and Florian Wirtz curled the ball into the box, Andrich snapping up a rebound to score.

Alonso’s side have now won or equalized in stoppage time 10 times this season in all competitions.

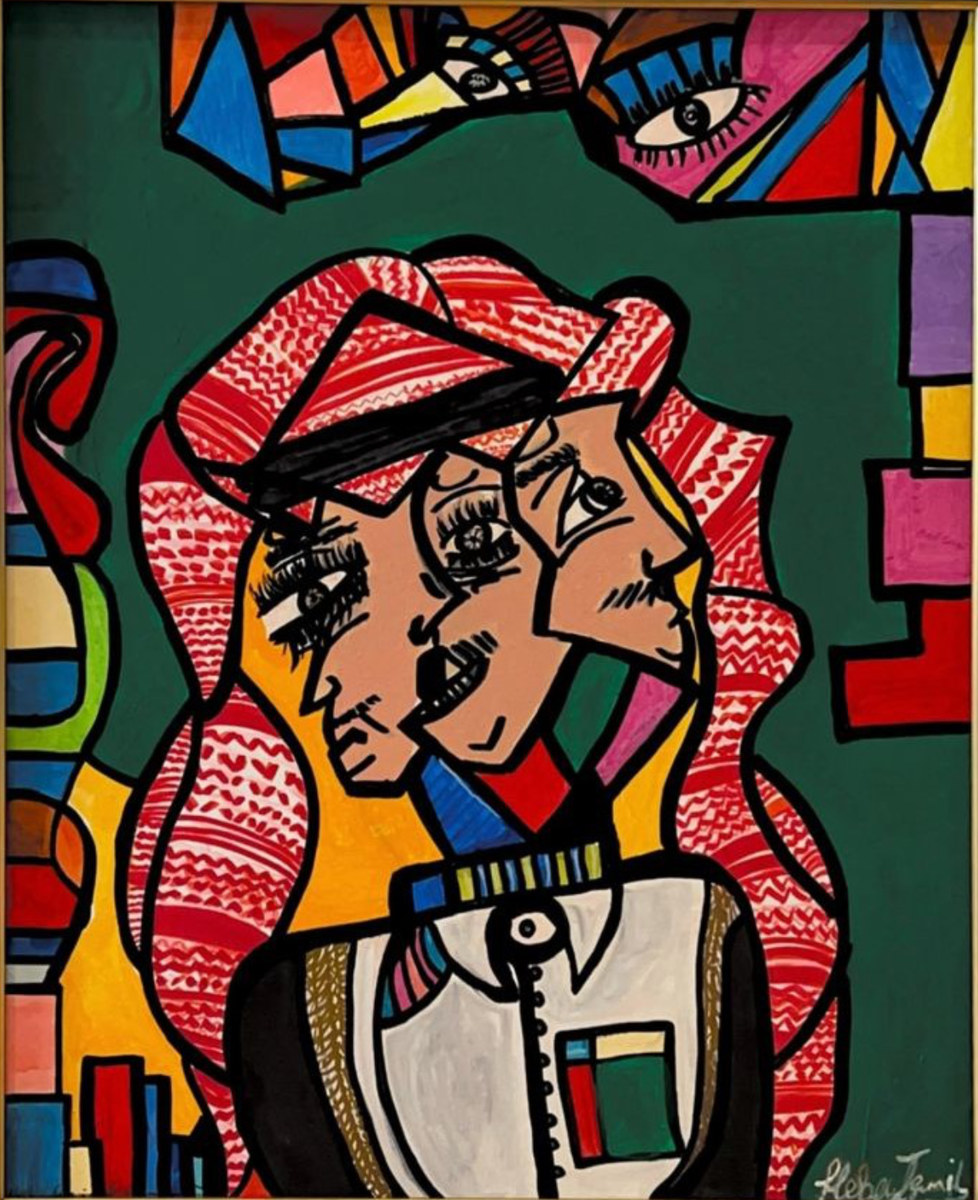

Heba Ismail brings Saudi representation to NFT ecosystem

- Heba Ismail is highlighting ways for artists to flourish in the digital world

JEDDAH: Saudi artist Heba Ismail showcased her work at the Outer Edge Innovation Summit in Riyadh this week.

Commenting on her experience at the summit as one of the first Saudi artists to venture into the Web3 art scene, she said: “Having my paintings displayed on the event screens is a tremendous honor, offering global visibility and inspiring more Saudi and Arab artists to explore the diverse options available for sharing their art with the world.

“Through my participation with Nuqtah, the first Saudi NFT platform, I am eager to present my art on a global stage and connect with audiences in innovative ways,” she continued.

Non-fungible tokens — or NFTs — are, in this scenario, digital tokens that can be redeemed for a digital art work. Ismail is exploring their potential in the Saudi art scene.

HIGHLIGHTS

• With a professional background in dentistry, Heba Ismail found parallels between that meticulous work and her own creative process.

• Partnering with ChainVisory, a blockchain consultancy company, Ismail launched the Hebaism brand.

• It combines NFTs and original paintings, providing collectors with both digital and physical assets.

For Ismail, art has always been more than just a hobby — it’s been a lifelong calling. With a professional background in dentistry, Ismail found parallels between that meticulous work and her own creative process.

Inspired by movements including cubism, fauvism, and surrealism, Ismail’s art is a fusion of diverse influences and personal narratives “Each face represents a feeling and a vision documented on a painting. I paint poetry, and often times each piece is accompanied by a poem,” she said. “As a Saudi female, most of my paintings represent myself and my Saudi culture, which I am proud of. The characters are coded feelings, faces that tell a story — either joy, sadness, or acrimony.”

Her introduction to NFTs came in 2021, sparking a fascination with the technology and its potential. Partnering with ChainVisory, a blockchain consultancy company, Ismail launched her Hebaism brand, which combines NFTs and original paintings, providing collectors with both digital and physical assets.

As a female Saudi artist, I want to leave a mark and impact on every art platform, putting Saudi art on the map worldwide.

Heba Ismail, Saudi artist

“I wanted to keep the authentic classical painting process, yet the NFT world gave me a chance to meet and discover different ways to share my art and build a name and a brand,” she said. “It’s been an enlightening journey, uncovering the futuristic art process and connecting with a vibrant community through Web3.”

Ismail hopes to inspire other artists in the region to explore new avenues for artistic expression.

“As a female Saudi artist, I want to leave a mark and impact on every art platform, putting Saudi art on the map worldwide,” she said.