WASHINGTON: Senate leaders and moderate Democratic Sen. Joe Manchin struck a deal over emergency jobless benefits, breaking a logjam that had stalled the party’s showpiece $1.9 trillion COVID-19 relief bill.

The compromise, announced by the West Virginia lawmaker and a Democratic aide late Friday, seemed to clear the way for the Senate to begin a climactic, marathon series of votes and, eventually, approval of the sweeping legislation.

The overall bill, President Joe Biden’s foremost legislative priority, is aimed at battling the killer pandemic and nursing the staggered economy back to health. It would provide direct payments of up to $1,400 to most Americans and money for COVID-19 vaccines and testing, aid to state and local governments, help for schools and the airline industry and subsidies for health insurance.

Shortly before midnight, the Senate began to take up a variety of amendments in rapid-fire fashion. The votes were mostly on Republican proposals virtually certain to fail but designed to force Democrats to cast politically awkward votes. It was unclear how long into the weekend the “vote-a-rama” would last.

More significantly, the jobless benefits agreement suggested it was just a matter of time until the Senate passes the bill. That would ship it back to the House, which was expected to give it final congressional approval and whisk it to Biden for his signature.

White House press secretary Jen Psaki said Biden supports the compromise on jobless payments.

Friday’s lengthy standoff underscored the headaches confronting party leaders over the next two years — and the tensions between progressives and centrists — as they try moving their agenda through the Congress with their slender majorities.

Manchin is probably the chamber’s most conservative Democrat, and a kingmaker in the 50-50 Senate. But the party can’t tilt too far center to win Manchin’s vote without endangering progressive support in the House, where they have a mere 10-vote edge.

Aiding unemployed Americans is a top Democratic priority. But it’s also an issue that drives a wedge between progressives seeking to help jobless constituents cope with the bleak economy and Manchin and other moderates who have wanted to trim some of the bill’s costs.

Biden noted Friday’s jobs report showing that employers added 379,000 workers — an unexpectedly strong showing. That’s still small compared to the 10 million fewer jobs since the pandemic struck a year ago.

“Without a rescue plan, these gains are going to slow,” Biden said. “We can’t afford one step forward and two steps backwards. We need to beat the virus, provide essential relief, and build an inclusive recovery.”

The overall bill faces a solid wall of GOP opposition, and Republicans used the unemployment impasse to accuse Biden of refusing to seek compromise with them.

“You could pick up the phone and end this right now,” Sen. Lindsey Graham, R-S.C., said of Biden.

But in an encouraging sign for Biden, a poll by The Associated Press-NORC Center for Public Affairs Research found that 70% of Americans support his handling of the pandemic, including a noteworthy 44% of Republicans.

The House approved a relief bill last weekend that included $400 weekly jobless benefits — on top of regular state payments — through August. Manchin was hoping to reduce those costs, asserting that level of payment would discourage people from returning to work, a rationale most Democrats and many economists reject.

As the day began, Democrats asserted they’d reached a compromise between party moderates and progressives extending emergency jobless benefits at $300 weekly into early October.

That plan, sponsored by Sen. Tom Carper, D-Delaware, also included tax reductions on some unemployment benefits. Without that, many Americans abruptly tossed out of jobs would face unexpected tax bills.

But by midday, lawmakers said Manchin was ready to support a less generous Republican version. That led to hours of talks involving White House aides, top Senate Democrats and Manchin as the party tried finding a way to salvage its unemployment aid package.

The compromise announced Friday night would provide $300 weekly, with the final check paid on Sept. 6, and includes the tax break on benefits.

During the “vote-a-rama,” the Senate narrowly passed an amendment from Sen. Rob Portman, R-Ohio, that would have extended the $300 unemployment insurance benefit to July 18. But Portman’s victory was short-lived and the proposal was canceled out when the chamber subsequently passed the unemployment insurance proposal worked out by the Democrats.

Before the unemployment benefits drama began, senators voted 58-42 to kill a top progressive priority, a gradual increase in the current $7.25 hourly minimum wage to $15 over five years.

Eight Democrats voted against that proposal, suggesting that Sen. Bernie Sanders, I-Vermont, and other progressives vowing to continue the effort in coming months will face a difficult fight.

That vote began shortly after 11 a.m. EST and was not formally gaveled to a close until nearly 12 hours later as Senate work ground to a halt amid the unemployment benefit negotiations.

Senate Minority Leader Mitch McConnell chided Democrats, calling their daylong effort to work out the unemployment amendment a “spectacle.”

“What this proves is there are benefits to bipartisanship when you’re dealing with an issue of this magnitude,” McConnell said.

Republicans criticized the overall relief bill as a liberal spend-fest that ignores that growing numbers of vaccinations and signs of a stirring economy suggest that the twin crises are easing.

“Democrats inherited a tide that was already turning.” McConnell said.

Democrats reject that, citing the job losses and numerous people still struggling to buy food and pay rent.

“If you just look at a big number you say, ‘Oh, everything’s getting a little better,’” said Senate Majority Leader Chuck Schumer, D-N.Y. “It’s not for the lower half of America. It’s not.”

Friday’s gridlock over unemployment benefits gridlock wasn’t the first delay on the relief package. On Thursday Sen. Ron Johnson, R-Wisconsin, forced the chamber’s clerks to read aloud the entire 628-page relief bill, an exhausting task that took staffers 10 hours and 44 minutes and ended shortly after 2 a.m. EST.

Democrats made a host of other late changes to the bill, designed to nail down support. They ranged from extra money for food programs and federal subsidies for health care for workers who lose jobs to funds for rural health care and language assuring minimum amounts of money for smaller states.

In another late bargain that satisfied moderates, Biden and Senate Democrats agreed Wednesday to make some higher earners ineligible for the direct checks to individuals.

Senate Dems strike jobless aid deal, relief bill OK in sight

https://arab.news/gx5dz

Senate Dems strike jobless aid deal, relief bill OK in sight

- The overall bill, President Joe Biden’s foremost legislative priority, is aimed at battling the killer pandemic and nursing the staggered economy back to health

Europe to launch chamber of commerce in Riyadh

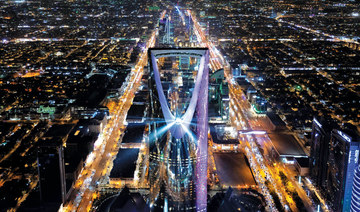

RIYADH: The first European Chamber of Commerce in the Gulf region will open next week in Riyadh, the EU’s special representative for the Gulf region has told Arab News.

Luigi Di Maio said the new body would bring Saudi and European companies together to enhance trade and cooperation.

“We’ve worked very hard with the Ministry of Investment, your Ministry of Trade. The EU delegation in Riyadh did a great job. And now we are going to inaugurate this chamber,” Di Maio said.

“That is in order to bring closer our companies, Saudi companies and European companies, to take on both sides the new opportunities of the Vision 2030 program … of our new European Green Deal, Next Generation EU, and others.”

Saudi Arabia’s Vision 2030 reform program had transformed the global business community’s view of the Kingdom, Di Maio said. “The ambitions, especially economic ambitions, of Saudi Arabia are totally changing perceptions of the Kingdom around the world,” he said. “There is a business community that is more and more interested in these ambitions, in this vision, and in a new generation of dreamers in this country.”

There was a growing recognition of the Kingdom’s diplomatic and economic influence, Di Maio said. “Saudi Arabia is becoming more and more the point of reference because now it is implementing its vision for the region that is not just an economic ambition, but is a new policy and new initiatives in order to de-escalate, to make the region in peace and wind down on tensions like the tension that we are experiencing now.

“The partnership and the strategic partnership between the EU and GCC countries, in particular with countries like Saudi Arabia, is vital.”

Red Sea Global offers more than 50 leisure activities: top official

RIYADH: Contrary to popular conception, sporting activities provided in the Red Sea and AMAALA are not just confined to water, but these destinations offer exciting leisure choices on land as well, said a top official.

Speaking to Arab News at the Future Hospitality Summit, Oliver Wood, senior director of Destination Development at Red Sea Global, said the destination currently offers more than 50 activities for visitors.

Wood said that RSG created three business entities last year — Galaxea, WAMA, and Akun.

Galaxea provides diving experiences to visitors, while WAMA and Akun offer water activities and adventure sports respectively.

“Galaxea is a coral that’s endemic to the Red Sea. It looks like, a kind of submarine galaxy that sits below a constellation and is beautiful. Then we created WAMA which is a way for water. And then we created Akun, which to us, is obviously ‘to be’ in the moment, start when you stand, breathe, leave everything behind,” said Wood.

He added: “So, all three of these businesses work together to do something that will reduce the misconceived fact that we are just water. We are land as well. In fact, similar to our surroundings, our land was created by water. Fifty million years ago, the sea was 120 km inland and 200 m higher. So we’re finding dinosaur bones. We’ve got petroglyphs, we’ve got ancient trade routes.”

According to Wood, some of the land activities offered in the Red Sea and AMAALA destinations include biking and hiking, with RSG recently delivering electric fat bikes for visitors.

“So for us, it’s about taking you out hiking. It’s taking you biking, supercool Akun electric fat bikes that we just got delivered. So, you can go sand, and gravel wherever you want. It’s about climbing to the top of our mountains,” he added.

The RSG executive also lauded the efforts of the Saudi Sailing Federation and the Saudi Water Sports and Diving Federation in promoting water sports in the Kingdom.

“The Saudi Sailing Federation, Saudi Water Sports and Diving Federation, they’re bringing this sport to the forefront. So, together we’ve created this blueprint so that you have more Saudis in the water, more tourists that are going in the water,” he noted.

Wood said that the availability of e-foils is one of the major attractions in the destination.

“E-foils is a surfboard that’s electrified, has this fin in the middle that pushes you above the water, so you glide through it without any friction. That is one of the most popular things we do. It is really good fun,” said Wood.

He added: “You can kayak through mangroves. And, then below the water is incredible. It’s one of the most well-preserved reefs in the world, and we’re very lucky to be working with KAUST on the scientific side.”

According to Wood, Galaxea is not just a diving brand, but it will allow visitors to understand the beauty and value of nature.

“There are lots of rare and endangered species beneath the water and it’s just incredible. It is a beautiful experience that allows you to reset your mind and just have a beautiful time in the Red Sea,” said the RSG official.

He revealed that RSG brand Corallium, which is a marine life institute, will help travelers understand more about protecting, preserving, and supporting water ecosystems.

Wood added that Corallium would also help divers communicate with experts in real-time, as they enjoy the beauty of the marine world.

According to the RSG website, Corallium can host 650 people at one time, and guests will be able to walk underwater, snorkel with rare species, participate in lab tours as well as dive into the depths of the Red Sea in a submarine.

“So as a diver, so you go snorkeling, you’re kind of shut off from it and experiencing it. Then you can speak to somebody afterward and understand.

“We try and extend that a bit further. you actually get to go out in these experiences and dive with a full face mask, communicating in real-time, under the water with our team,” he noted.

Wood also revealed that RSG has plans to create a scuba spa, where people can enjoy the silence in water.

Talking about the multiple options available for travelers in the Red Sea, he said: “You can be in the middle of desert dunes, you can be out in granite mountains. You can even go down to volcanoes. We have incredible volcanic lava fields that sit close to us. And then you can be in the water. You can be in front of 600-year-old pillars of coral reef. You can go through caves into the water.”

Wood also hinted that RSG is working toward offering Red Sea and AMAALA destinations to people who fall both in the luxury class and the middle range.

“We’re trying to show generosity in the value that we offer everybody there. We’ve tried to not only benchmark globally but try and push it right down so it is accessible to everybody and so that everybody can come and really enjoy it,” said Wood.

He added: “For me, it’s about building things around that enable people to come and get involved with it. So there are all sorts of things that we’re working on right now that will be revealed and are coming up.”

BlackRock, PIF launch multi-asset investment management platform in Riyadh

- First-of-its kind partnership aligns with PIF’s initiatives to drive further growth of the Saudi capital markets ecosystem, sector

- It will be anchored by an initial investment mandate of up to $5bn from PIF

RIYADH: BlackRock Saudi Arabia and the Public Investment Fund signed a memorandum of understanding on Tuesday which entitles the former to establish a Riyadh-based multi-asset investment platform.

It will be anchored by an initial investment mandate of up to $5 billion from PIF, subject to the achievement of agreed milestones between the parties, said a media statement.

Both parties have expressed the intention to establish BlackRock Riyadh Investment Management, which will encompass investment strategies across a range of asset classes. It is expected to be managed by a Riyadh-based portfolio management team and supported by BlackRock’s global asset management platform.

Larry Fink, BlackRock’s CEO, said: “We are excited to build on the deep partnership we have developed with PIF over many years to launch this first-of-its-kind international investment management platform in Saudi Arabia.

“The continued growth of the Kingdom’s capital markets, and diversification of its financial sector, will contribute to future prosperity for its citizens, the competitiveness of its companies and the resilience of its economy.”

Saudi Arabia has become an increasingly attractive destination for international investment as Vision 2030 comes to life, according to Fink.

He added: “We are pleased to offer investors from around the world the opportunity to take part in this exciting, long-term opportunity.”

Yazeed Al-Humied, PIF’s deputy governor and head of MENA (Middle East and North Africa) Investments, said: “PIF’s relationship with BlackRock is well established and growing. This new landmark agreement represents a step forward in PIF’s work in making the Saudi investment and asset management market more internationally diverse and more dynamic.”

As Saudi Arabia continues to transform its economy, BRIM will seek to support foreign institutional investment into the Kingdom and further enhance the Saudi asset management industry, broadening local capital markets while driving investor diversification across asset classes, facilitating knowledge sharing and the development of Saudi-based asset management talent.

BRIM will be fully integrated with BlackRock’s investment capabilities and operating platform, benefiting from global market expertise.

The non-binding memorandum is subject to satisfying certain necessary conditions, regulatory approvals, and fulfilling specified milestones.

Hospitality brands sign deals to expand in Saudi market

RIYADH: Top hospitality brands signed deals at the Future Hospitality Summit in Riyadh to capitalize on the opportunities available in the Kingdom.

France-based Accor Group said it will strengthen its position in the Kingdom with the addition of more than 25,000 rooms and the launch of a wide variety of brands.

The global hospitality group also recently launched Accor One Living, an initiative offering specialized knowledge in mixed-use and branded residential development.

Ladun Investment Co. signed an agreement with Cheval Collection. The partnership encompasses multiple contracts for the construction and operation of Cheval Ladun Living, which is a hotel apartment tower located on King Fahd Road, near the King Abdullah Financial Center in Riyadh.

The deal represents Cheval Collection’s inaugural project in Saudi Arabia, featuring 130 residential units of varying sizes, from one to three rooms, alongside amenities like a gym, a swimming pool, and a sauna.

The project’s construction is scheduled to begin this year and will be completed in 2027.

Marriott International, Inc. and Al Qimmah Hospitality, a subsidiary of BinDawood Trading, signed an agreement to bring the JW Marriott brand to Jeddah.

Located on the Jeddah Corniche, the hotel is expected to become a prime destination for luxury-seeking travelers who desire a waterfront escape.

“The signing of JW Marriott Hotel Jeddah continues to reflect the strong growth opportunities for our luxury brands across the Kingdom. As part of the country’s Vision 2030 framework, Jeddah continues to build itself as a leisure and business destination,” Chadi Hauch, regional vice president of Marriott International, development of the Middle East, said in a press statement.

On behalf of Al Qimmah Hospitality, Abdul Razzaq BinDawood commented: “We will leverage our expertise and experience in the retail and hospitality sectors to make JW Marriott Hotel Jeddah a successful addition to the city’s landscape.”

Baheej Tourism Development Co., a joint venture between ASFAR, the Saudi tourism investment company owned by the Public Investment Fund, and the Tamimi-AWN Alliance, signed a deal with Kerten Hospitality.

The agreement grants Kerten Hospitality management of Baheej’s hotel in Yanbu under the premium Cloud 7 brand.

Cloud 7 is an innovative hotel and residential lifestyle brand, recognized for its designs, check-in lobbies, healthy food options, and retail boutiques.

“Baheej’s collaboration with Kerten Hospitality underlines our core principle: empowering partners and subsidiaries through our expansive network,” Fahad bin Mushayt, CEO of ASFAR said.

The PIF-owned company also signed agreements with Mantis and KMC to manage the operations of Al Baha Mountain Lodge & Adventure Park.

Cashless payments in Saudi Arabia to rise by 7.6% in 2024

RIYADH: Cashless payments in Saudi Arabia are expected to surge by 7.6 percent in 2024 to SR550 billion ($146.8 billion) as compared to SR511.5 billion the previous year, a report said.

The report issued by GlobalData, a London-based data analytics and consulting company, projected the Saudi card payments market to grow at an annual rate of 6.4 percent between 2024 and 2028 to reach SR705.2 billion.

The uptick comes amid the Saudi government’s push for a cashless society by encouraging consumers to switch to cards for financial transactions.

“While cash has traditionally been a preferred method of payment in Saudi Arabia, its usage is on the decline in line with the rising consumer preference for electronic payments,” said Ravi Sharma, a lead banking and payments analyst at GlobalData.

He added: “The country has a robust digital payment infrastructure, supported by a developing card market and a well-established card acceptance infrastructure.”

Sharma further noted that Saudi Arabia’s government is taking effective steps to enhance the infrastructure in the country by encouraging merchants to adopt at least one electronic payment option apart from cash.

The report, however, added that cash remains an integral part of the Saudi consumer payments landscape, particularly for lower-value transactions, but the usage of hard currency is showing signs of decline.

Promoting digital payments is crucial for Saudi Arabia, as the Kingdom’s Vision 2030 aims to reduce cash transactions and increase the share of electronic payments to 70 percent of all transactions by 2025.

“The (COVID-19) pandemic changed the way Saudi consumers make payments, with an increasing number of consumers preferring contactless payments,” said Sharma.

He added: “Contactless cards have been on the rise in the country with the Saudi Arabian central bank reporting 363.4 million transactions using NFC-enabled mada cards in February 2024 compared to 331.7 million in February 2023.”

In terms of card preference, debit cards dominate the overall card payment space, accounting for 85 percent of the overall card payment value in 2023.

GlobalData pointed out that the government’s financial inclusion initiatives, consumers’ preference for debt-free payments, and prudent consumer spending have resulted in the domination of debit cards in the Kingdom.

“Saudi consumers are gradually embracing electronic payments, moving away from cash, supported by government push, improvements in payment infrastructure, growing consumer awareness, and rising adoption of newer technology like contactless,” added Sharma.

In April, data released by the Saudi Central Bank revealed that payments made through point-of-sale terminals in the Kingdom experienced a significant 20 percent annual increase in February, totaling SR53.72 billion.

The largest portion of POS spending in February was allocated to beverages and food, comprising 15.7 percent or SR8.43 billion.

This was followed by spending on restaurants and cafes, accounting for 15 percent of the total, reaching SR8.02 billion.