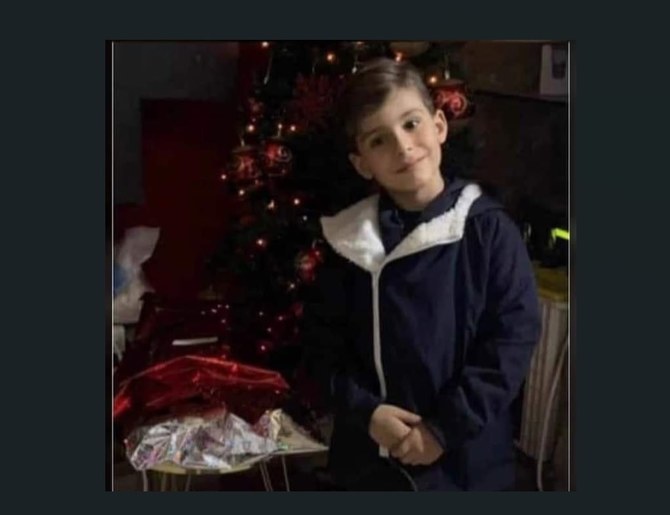

DUBAI: Three suspects have been detained over their purported responsibility for the death of a Lebanese boy who suffered a heart attack when he saw horror scenes being filmed for TikTok.

Mohamed Haydar Istanbuli, 6, was reported to have been playing in his neighborhood in Lebanon’s coastal city of Tyre near the Roman ruins when he saw two girls dressed in black and carrying swords while running.

It is believed that the scene scared Istanbuli when he saw them with their heads covered while running in a sequence they were believed to be filming for future use on TikTok.

The boy had a heart attack and died.

A Lebanese Security Forces officer told Arab News on condition of anonymity that two girls under 18 and a man, who was flying a filming drone, had been arrested on Tuesday pending further investigation by prosecutors.

Cardiologist Dr. Afif Khafaja, who conducted Istanbuli’s autopsy, told Arab News that it was not easy to tell whether the boy had a precondition or any undiscovered birth deformity.

Khafaja added: “Practically speaking there must be causes for such cases of sudden heart seizures to happen.

“Definitely the boy must have been suffering from some precondition such as a birth abnormality or intermittent heartbeat or some medical condition in his aorta.”

The cardiologist said in the medical report that Istanbuli had died on May 12 due to a severe heart attack that led to a seizure followed by acute pulmonary congestion.

He added: “Usually such conditions happen in cases of stress for a child suffering an undiagnosed birth abnormality.

“Patients suffering from such conditions could be saved if an electrical shock (via a defibrillator) is applied to the heart to change the rhythm back to normal.”

The LSF officer said the boy’s father had lodged a criminal complaint against those he believed were responsible for his son’s death.

South Lebanon’s General Prosecutor Judge Diala Wansa kept the three suspects in custody pending further investigation.

Local media reported that two girls and two men — who work in videography — had not obtained permission from Lebanon’s Directorate General of Antiquities to film at Tyre’s Roman ruins.

The LSF officer said: “The fourth suspect failed to show up for investigation.”

3 arrested after scared Lebanese boy dies after seeing horror scenes filmed for TikTok

https://arab.news/mw83n

3 arrested after scared Lebanese boy dies after seeing horror scenes filmed for TikTok

- Mohamed Haydar Istanbuli, 6, suffers fatal heart attack after seeing girls dressed in black with covered faces carrying swords

- Cardiologist says it is not easy to tell whether the victim had a precondition, any undiscovered birth deformity

Saudi cement sector poised for global lead through digital maturity and circular economy practice

RIYADH: Saudi Arabia’s cement industry is poised to maintain its position as a key player in the global market, by harnessing circular economy principles and navigating challenges using digital innovation, according to an industry expert.

Amr Nader, CEO and co-founder of cement consultancy A3&Co, told Arab News that most of the Kingdom’s plants in the sector boast state-of-the-art technologies, which will enable them to reach digital maturity for achieving operational excellence and de-carbonization goals.

While some plants are initiating proper strategic initiatives in this area, others are still in the early stages of trials.

However, Nader believes that the transition to digital maturity is on the priority list of most plants and is expected to materialize within the next 2 to 5 years.

According to TechSCI Research, Saudi Arabia’s white cement market reached a value of $165.11 million in 2022, and is anticipated to grow at a compounded annual growth rate of 11.93 percent during the forecast period spanning from 2024 to 2028.

Key projects like NEOM and Qiddiya, along with the expansion of transportation networks and entertainment centers, have spurred a notable increase in the demand for high-quality cement in the Kingdom.

Nader believes this growth will come alongside major shifts in the sector, and said: “We anticipate a cost reduction and improved value addition, leveraging circular economy and even for net-zero transition if the right technologies at the efficient sizes are adopted.”

The CEO elaborated on the significance of adopting oxy-fuel technology at suitable scales, emphasizing its use of oxygen and recirculated flue gasses for burning fuels instead of air.

This approach, combined with increased reliance on renewable energy sources and the anticipated integration of low-carbon hydrogen as a fuel source, indicates the potential for Saudi Arabia’s cement industry to sustain its competitive advantage beyond 2030 according to Nader.

These initiatives form part of a comprehensive de-carbonization strategy aimed at lessening the sector’s ecological impact while preserving its market standing.

Nader further highlighted that the Saudi competitive pricing edge is driven by lower production costs even after factoring in carbon adjustment border taxes, potentially increasing exports to regions with stringent carbon regulations.

“In regard to the carbon boundary tax of Europe and other carbon boundary taxes in the world, we see that as an opportunity for further export from Middle East plants that will early adopt near-zero transitions in a time frame between 2024 and 2028,” he said.

Carbon boundary taxes, also known as carbon border adjustment mechanisms, are policies implemented by governments to address carbon leakage.

They ensure that industries subject to carbon pricing within their jurisdictions remain competitive with foreign industries that may not face similar levies..

These taxes aim to prevent the relocation of industries to countries with weaker climate policies while also encouraging other nations to adopt similar carbon pricing measures.

Nader highlighted challenges affecting demand in the cement sector, such as heightened sea freight costs, reduced vessel availability due to geopolitical tensions, and increased pricing by Saudi plants to counter higher energy costs from Aramco.

“Despite the increase in fuel prices by average 100 percent for all fuels, the production cost in efficient Saudi plants is still lower than the global average by approximately 15 percent and there is still room to improve that by adopting operational excellence,” he added.

He explained that large companies in the Kingdom, with capacities exceeding 8,000 tonnes per day, have significant opportunities for improvement by implementing Operational Excellence Strategies and early adoption of near-zero science-based targets initiative verified strategies.

This will not only reduce costs further but also enables them to remain below the global cost average by the same 15 percent, even with the anticipated increase in energy prices next year, he added.

Reduced government investment has posed another challenge according to Nader, causing a slowdown in large-scale projects and consequently diminishing the demand for cement.

This trend translated into a 4 percent decline in domestic sales and a 30 percent drop in exports for Saudi Arabia’s 17 cement firms during the first quarter of 2024 compared to the same period last year, as reported by Al-Yamama Cement.

Notably 97 percent of cement sales were domestic, with only 3 percent being exported.

Despite this drop in sales, the Kingdom stands as the largest cement producer in the region, housing several of the most significant cement-manufacturing firms in the area, according to Global Cement.

The most prominent firms in Saudi Arabia, based on market capitalization according to Bloomberg data, include Al Yamama Cement, with a market cap of SR6.95 billion, followed by Saudi Cement at SR6.82 billion, Southern Province Cement at SR5.5 billion, then Qassim Cement, and Yanbu Cement.

Nader linked the recent decline in domestic sales to certain giga-projects in the Kingdom that demand green cement, a product not commonly manufactured in most of Saudi Arabia’s plants.

“Nevertheless it must be noted that Saudi Arabia consumption per capita is still one of the highest in the world at approximately 1.3 tonnes per capita yet the utilization of the sector is less than 60 percent due to high installed capacity in the period between 2013 and 2017,” Nader added.

In its April report, Al-Jazira Capital also associated the decline with the increased influence of Ramadan on sales, noting that the holy month spanned 21 days in March 2024, compared to just 9 days in the previous year.

Nader had emphasized in a February interview with Aggregates Business that the Middle East’s cement plants, characterized by their large size, enjoy advantages in economies of scale and operational efficiency. With most plants equipped with modern technology and automated processes, they outperform their European counterparts, some of which date back to the 1950s.

Additionally, the region’s abundant solar, wind, and land resources present opportunities for the adoption of green energy, positioning the Middle East cement sector to lead in sustainability initiatives globally.

Looking ahead, Nader foresees a growing emphasis on sustainability and de-carbonization in the region, leading to increased production of green products.

Furthermore, he predicts a doubling of cement exports from the Middle East within the next two to three years, with Saudi Arabia, the UAE, and Algeria currently leading as the largest exporters.

Russia outlaws SOTA opposition news outlet

- Authorities said outlet tries to destabilize the socio-political situation in Russia

- Move could criminalize SOTA content and puts its reporters at risk of arrest

LONDON: Russia declared opposition media outlet SOTA “undesirable” on Thursday, a move that could criminalize the sharing of its content and put its reporters at risk of arrest.

Authorities in Russia have declared dozens of news outlets, think tanks and non-profit organizations “undesirable” since 2015, a label rights groups say is designed to deter dissent.

In a statement, Russia’s Prosecutor General accused SOTA of “frank attempts to destabilize the socio-political situation in Russia” and “create tension and irritation in society.”

“Such activities, obviously encouraged by so-called Western inspirers, have the goal of undermining the spiritual and moral foundations of Russian society,” it said.

It also accused SOTA of co-operating with TV Rain and The Insider, two other independent Russian-language outlets based outside of the country that are linked to the opposition.

SOTA Project, which covers opposition protests and has been fiercely critical of the Kremlin, denied it had anything to do with TV Rain and The Insider and rejected the claims.

But it advised its followers in Russia to “remove reposts and links” to its materials to avoid the risk of prosecution. SOTA’s Telegram channel has around 137,000 subscribers.

“Law enforcement and courts consider publishing online to be a continuing offense. This means that you can be prosecuted for reposts from 2023, 2022, 2021,” it said.

SOTA Project was born out of a split with a separate news outlet called SOTAvision, which still covers the opposition but distanced itself from the prosecutors’ ruling on Thursday.

Since launching its offensive in Ukraine, Moscow has waged an unprecedented crackdown on dissent that rights groups have likened to Soviet-era mass repression.

Among other organizations labelled as “undesirable” in Russia are the World Wildlife Fund, Greenpeace, Transparency International and Radio Free Europe/Radio Liberty.

Suspected militants bomb second girls school in a month in northwest Pakistan

- The attack damaged part of the facility in South Waziristan, however, no one was injured in its wake

- Though nobody claimed responsibility for the bombing, suspicion is likely to fall on the Pakistani Taliban

PESHAWAR: Suspected militants blew up another school for girls in a former stronghold of the Pakistani Taliban in Pakistan’s northwestern Khyber Pakhtunkhwa province, police and residents said on Friday.

The attack happened in the South Waziristan district that borders Afghanistan. It was the second one this month after another school was badly damaged in the region, according to district police Spokesman Habib Islam.

The overnight attack damaged one room of the facility, however, no one was hurt in its wake.

“A loud bang was heard in the night and police found early morning that a newly built girls’ school in Karikot, a village close to district headquarters of Wana City, was damaged in the explosion,” Islam told Arab News.

No one immediately claimed responsibility for bombing the school, but suspicion was likely to fall on the Pakistani Taliban, who have targeted girls’ schools in the province in the past.

A police officer from Wana said the management of the damaged school had received several threats in the past.

Jalal Wazir, general secretary of the Wana Welfare Association, regretted the bombing and said education was of “paramount importance” to beat illiteracy in the region.

“We can’t compete in today’s world if our girls are left uneducated,” Wazir said. “We will work to promote women education because if you educate a single girl, you educate an entire family.”

On May 9, unidentified militants had blown up a girls’ school on the outskirts of Miran Shah city in the neighboring North Waziristan district, prompting Prime Minister Shehbaz Sharif to direct authorities to immediately rebuild the damaged facility.

In May last year, two girls’ schools were blown up in the Mir Ali area of the North Waziristan district.

Pakistan witnessed multiple attacks on girls’ schools until 2019, especially in the Swat Valley and elsewhere in the northwest where the Pakistani Taliban long controlled the former tribal regions. In 2012, the insurgents attacked Malala Yousafzai, a teenage student and advocate for the education of girls who went on to win the Nobel Peace Prize.

OpenAI strikes deal to bring Reddit content to ChatGPT

- Deal underscores Reddit’s attempt to diversify beyond its advertising business

- Content will be used to train AI models

LONDON: Reddit has partnered with OpenAI to bring its content to popular chatbot ChatGPT, the companies said on Thursday, sending the social media platform’s shares up 12 percent in extended trade.

The deal underscores Reddit’s attempt to diversify beyond its advertising business, and follows its recent partnership with Alphabet to make its content available for training Google’s AI models.

ChatGPT and other OpenAI products will use Reddit’s application programming interface, the means by which Reddit distributes its content, following the new partnership.

OpenAI will also become a Reddit advertising partner, the company said.

Ahead of Reddit’s March IPO, Reuters reported that Reddit struck its deal with Alphabet, worth about $60 million per year.

Investors view selling its data to train AI models as a key source of revenue beyond Reddit’s advertising business.

The social media company earlier this month reported strong revenue growth and improving profitability in the first earnings since its market debut, indicating that its Google deal and its push to grow its ads business were paying off.

Reddit’s shares rose 10.5 percent to $62.31 after the bell. As of Wednesday’s close, the stock is up nearly 12 percent since its market debut in March.

Pakistan says will accelerate progress on major connectivity projects with China

- The understanding to this effect was reached during Pakistan Deputy Prime Minister Ishaq Dar’s visit to China

- The visit comes amid Pakistan’s push for foreign investment, with Islamabad seeing flurry of high-level exchanges

ISLAMABAD: Pakistan and China have resolved to accelerate progress on major connectivity projects and strengthen cooperation in multiple fields, Pakistan’s Foreign Office said on Friday, amid an increase in bilateral engagements with longtime ally Beijing to boost foreign investment in Pakistan.

The understanding to this effect was reached during Pakistan Deputy Prime Minister Ishaq Dar’s ongoing visit to China, where he met Chinese Foreign Minister Wang Yi and other top officials.

Beijing has been one of Islamabad’s most reliable foreign partners in recent years and has invested over $65 billion in energy and infrastructure projects as part of the China-Pakistan Economic Corridor (CPEC).

The project, part of President Xi Jinping’s ambitious Belt and Road Initiative, aims to connect China to the Arabian Sea via a network of roads, railways, pipelines and ports in Pakistan, and help Islamabad expand and modernize its economy.

“The two sides will work together to forge an upgraded version of CPEC by jointly building a growth corridor, a livelihood enhancing corridor, an innovation corridor, a green corridor by aligning them with Pakistan’s development framework and priorities,” said Mumtaz Zahra Baloch, a Pakistan foreign office spokeswoman, while briefing reporters on Dar’s visit.

“Together we will accelerate progress on major connectivity projects, including upgradation of ML-1 (Main Line-1), the Gwadar port, realignment of KKH (Karakoram Highway) phase-2, strengthen cooperation in agriculture, industrial parks, mining and information technology.”

The $6.8 billion ML-1 project is aimed at upgrading and dualizing the 1,872-kilometer existing railway track from the southern Pakistani port city of Karachi till Peshawar in the country’s northwest, while the port in Pakistan’s southwestern Gwadar city lies at the heart of CPEC.

Dar’s visit comes amid Pakistan’s recent push for foreign investment, with Islamabad seeing a flurry of high-level exchanges from diplomats and business delegations in recent weeks from Saudi Arabia, Japan, Azerbaijan, Qatar and other countries.

Earlier in the day, Prime Minister Shehbaz Sharif’s office said the premier had invited a Chinese research and investment firm, MCC Tongsin Resources, to invest in Pakistan’s mining sector and assured it of “maximum facilitation.” The statement came after Sharif’s meeting with a delegation of MCC Tongsin Resources, led by Chairman Wang Jaichen, in the federal capital of Islamabad.

“The government is taking steps on priority basis to increase foreign investment in the country,” Sharif was quoted as saying by his office. “In order to increase the exports of Pakistan, investment for the extraction of minerals, their processing and export will be fully facilitated.”

Sharif has vowed to rid the country of its chronic macroeconomic crisis through foreign investment and efficient handling of the economy.