DUBAI: In the oil city of Houston, Texas, in March 2019, US Secretary of State Mike Pompeo was in backslapping mood.

Addressing the annual CERAWeek gathering of energy experts, the “oil man’s Davos,” he milked the applause for America’s resurgence in the global oil business, which later that year would see the US become the biggest producer, a major exporter, and self-sufficient in oil for the first time since the 1970s.

“Come follow America’s energy blueprint,” he said, to enthusiastic approval.

Now, that blueprint is being ripped to shreds. American oil, judging by the market carnage this week, is effectively bust.

The brief era of US dominance of global energy markets is over for the foreseeable future.

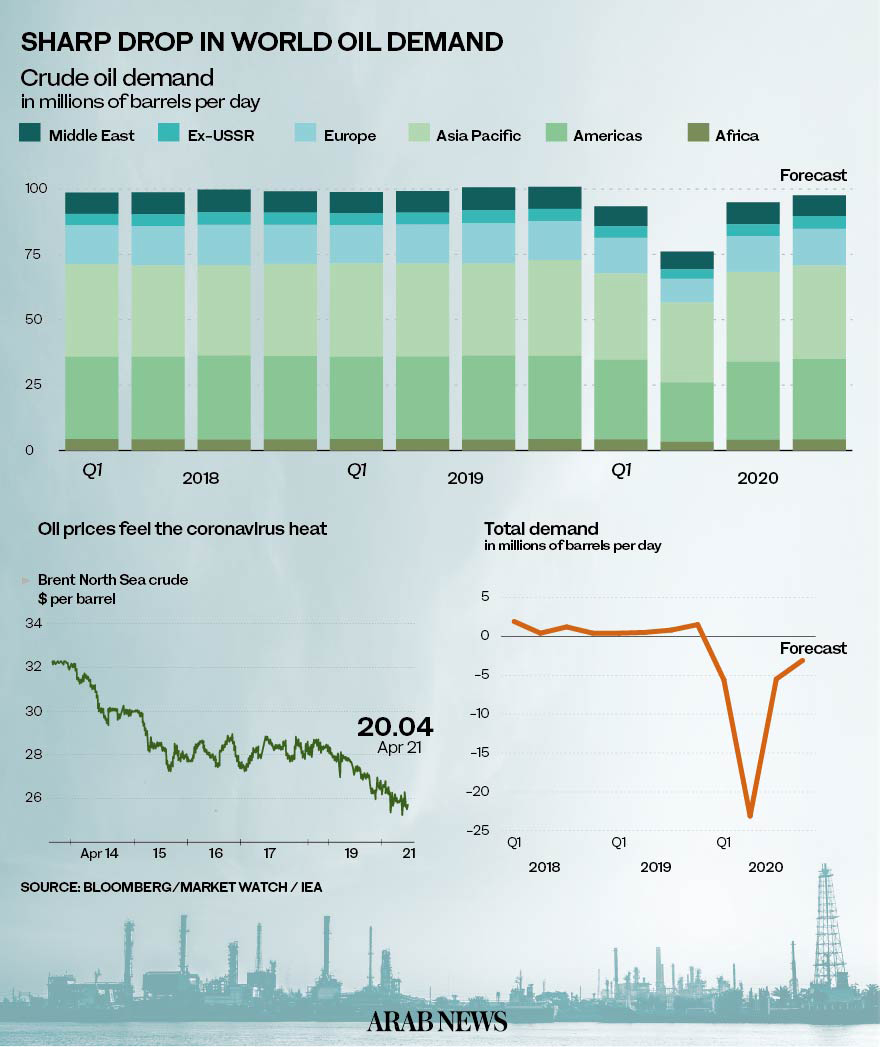

The price of a barrel of West Texas Intermediate (WTI), the US benchmark, fell like a stone on Monday, hitting zero and then swinging rapidly into “negative” territory.

At one stage, the price was saying that oil companies would pay a consumer $40 to take an unwanted barrel of oil off its hands.

The repercussions for the US oil industry will be severe.

Already, smaller oil companies have started to dismantle drilling operations in Texas, New Mexico and other oil states that stoked the US oil surge.

The “rig count,” the number of pumps in operation, is half of what is was last year.

It is hard to overestimate the implications for the oil states’ economies, for US election-year politics, and for the global economy battling the ravages of the coronavirus disease (COVID-19) pandemic.

There is also likely to be resonance in Saudi Arabia and Russia, the two other leading oil producers.

They had been attempting to stabilize the global market amid the biggest threat it has faced in its history – the savage destruction of demand for their product caused by the global economic lockdown.

“This is a severe blow to American energy pride,” said a US oil analyst who did not want to be named.

“Even if there are extra special reasons for it, and even if WTI oil manages to climb out of this mess sometime in the future, the world picture for the oil industry is changed completely.”

To understand how America got itself into this mess you have to look at how it became oil dominant in the first place.

It is all to do with the unique combination of technology and finance that prompted the boom in shale production over the past 15 years in what Pompeo in Houston said was a “modern-day miracle.”

Unlike conventional crude oil drilled in the Arabian Gulf, shale is a more complicated process that essentially involves squeezing crude out of oil-bearing rocks.

It required new techniques such as horizontal drilling, and complex chemical processing before it could be suitable for refining. It also required largescale investment.

Because the big wealthy oil companies largely ignored shale in the early days, banks and other investors looking for a quick return bore the brunt – and the risk – of shale investment.

This formula – cutting-edge energy technology mixed with American entrepreneurial capital – worked well when oil prices were comparatively high.

The first boom in shale came during the recovery in oil prices after the end of the global financial crisis in 2008, when oil went to more than $150 a barrel.

At that level, shale was a no-brainer, guaranteed to make big profits for the operators.

That first boom period ended when oil prices collapsed from the summer of 2014 onwards.

By the time WTI went below $30 a barrel in early 2016, hundreds of shale companies had gone bust, or had simply packed up their rigs and gone home, leaving the oil in the ground.

Opinion

This section contains relevant reference points, placed in (Opinion field)

What persuaded them to load up and get pumping again was OPEC+, the alliance led by Saudi Arabia and Russia that from late 2016 onwards led a succession of agreements between OPEC members and other oil producers to reduce output.

That alliance involved compromises on all sides.

Saudi Arabia and Russia sold less oil than they could, but at higher prices than the markets would otherwise give.

The US shale business – comprising around 65 percent of total American output – was the big winner.

As long as the crude price stayed above roughly $40, it was profitable. Pulitzer Prize-winning oil expert Daniel Yergin described the relationship between OPEC and shale as “mutual coexistence,” with both sides learning to live with prices that are lower than they would like.

Not everybody in that relationship saw it like that.

When the OPEC+ deal unraveled at the beginning of last month, one Saudi oil executive told Arab News: “We (OPEC+) did a deal but the real beneficiary was American oil. For three years, we kept them in business. But times have changed.”

The end of the OPEC+ deal threw an extra layer of volatility into the global business, but by then it was anyway on the cusp of the biggest challenge in its history.

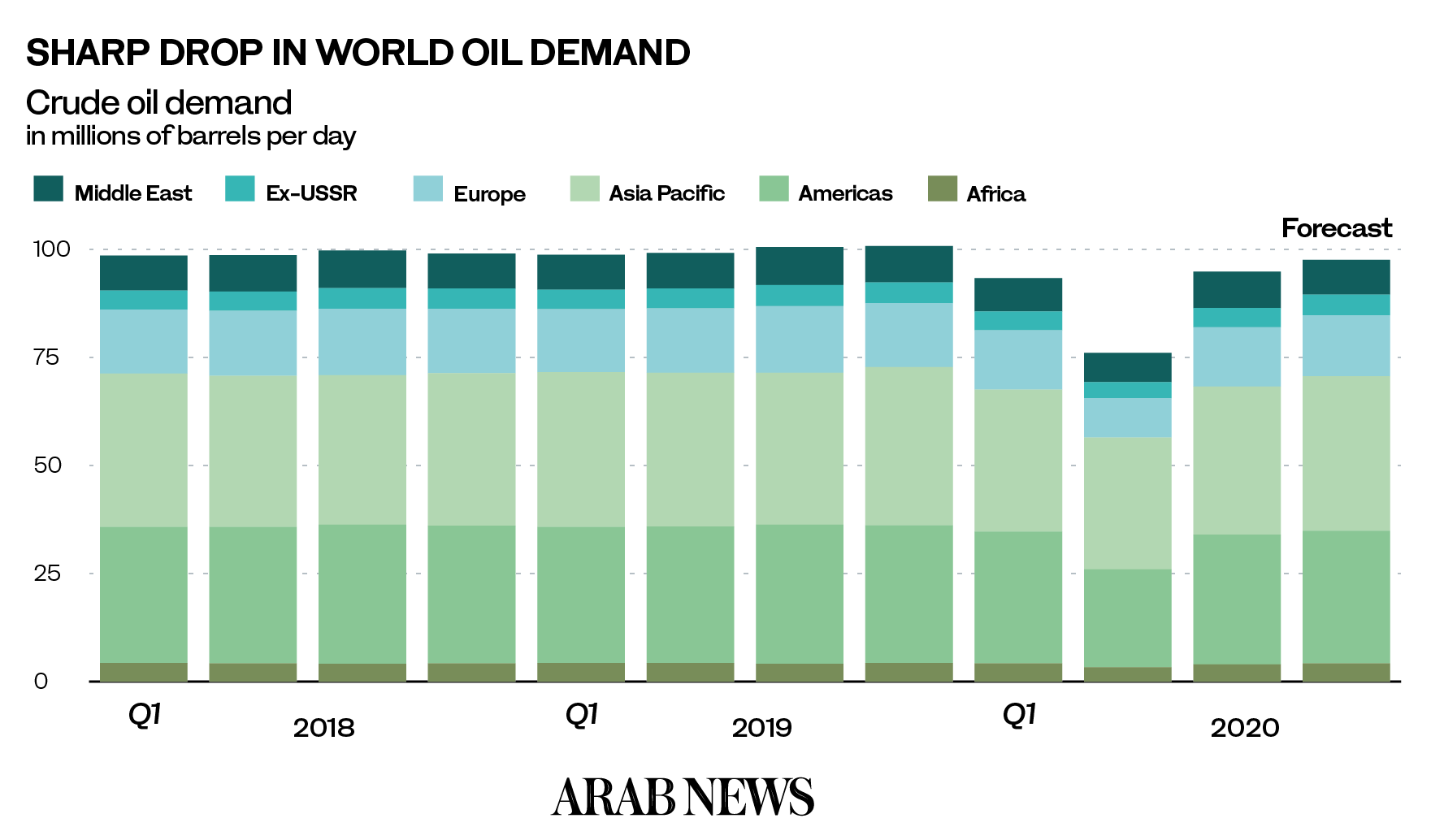

The global pandemic and ensuing lockdown on economic activity and travel around the world was destroying demand on an unparalleled scale.

With around 30 million barrels of oil per day lost from demand, even the eventual revival of the OPEC+ alliance – which removed a mere 9.7 million barrels from the supply side – could not avert this week’s disaster for US shale.

There were significant technical reasons for the collapse into negative territory on Monday evening for WTI.

One monthly contract was ending, leaving a big trader exposed, which accelerated the rout.

But fundamental to the collapse was the fact that America was simply producing too much oil, that nobody was using.

US storage is virtually full, meaning that there is nowhere to put the oil that people are not burning in industry, or their cars, or for air travel.

The option for American shale oil is stark: “Shut in” wells (oil industry jargon for closure) which involves physical risk to the oil reservoirs, not to mention the livelihoods of hundreds of thousands of oil workers across the US. Or have the banks and investors pull the plug, effectively causing the same catastrophe in the middle of a life-threatening pandemic.

In a US election year, with a “deal making” Trump who claimed to have saved “hundreds of thousands of jobs” when he helped broker the revived OPEC+ deal, the political repercussions of such a hit to the economy are significant.

Texas will still have its oil in the ground, of course, and it is not inconceivable that sometime in the future prices will rise to make sense to gear up the rigs again, as they did in 2016.

But with the economic effects of the pandemic hard to predict, it is almost impossible to say when that will be, or whether more efficient producers such as Saudi Arabia and Russia will have permanently won over what were previously US markets.

Or, indeed, if the world will have learned to permanently live with less oil.

For the time being, America’s “modern-day miracle” is over.