LONDON: Australian Ambassador to Saudi Arabia Ridwaan Jadwat congratulated Saudi Arabia on its presidency of the G20 during the coronavirus pandemic.

“It’s been a very difficult year for everybody. We congratulate not only the authorities but all the frontline health care workers who have been doing their very best to keep people safe,” Jadwat told Arab News.

Jadwat remarked on how the meetings scheduled between working groups, engagement groups and ministers hardly skipped a beat this year and praised the decision of the Saudi presidency to continue the G20 meetings virtually.

“The decision for leaders to meet virtually in November was appropriate, given the logistical and health challenges in the current context,” he said. “We hope that the leaders will have another opportunity in the future to visit the Kingdom.

“The G20 is an institution that comes into its own when most needed; it is more a rough-weather friend than a fair-weather one.”

Under the Saudi Arabian presidency, the G20 is bringing members together to address response and recovery measures to COVID-19. “Leaders met earlier this year in March to discuss the crisis at the extraordinary G20 leaders’ summit … and COVID-19 continues to be the key focus leading into the summit in November.”

Jadwat stressed the importance of strong multilateral institutions, such as the G20, in a time of unprecedented global challenges.

“They’re vital to international stability. It is more important now than ever for leaders to have open lines of communication. And this is doubly true for the G20, which brings together the world’s biggest economies, given the significant economic impact of the pandemic.”

Jadwat said that the G20 has a key role in creating the conditions for future prosperity.

“Australia is focused on job creation through supply-side reforms and on restoring demand and enabling a private sector-led recovery, which is very important. The G20 has a key role in promoting the importance of the multilateral trading system and in providing political guidance and support for World Trade Organization reform.”

In commenting on the summit’s theme for this year, “Realizing Opportunities of the 21st Century For All,” the ambassador said that it has taken on a new meaning during the pandemic.

“Saving lives has to be our top priority. Australia is committed to equitable access to a vaccine once it’s developed and is actively engaged in international efforts to this end, through the Gavi-led COVAX facility. We need to support the health capacity of all vulnerable and low-income countries across regions, including the small states in our region closer to Australia,” he said.

Australian Ambassador to Saudi Arabia Ridwaan Jadwat. (Supplied)

Jadwat emphasized prioritizing economic growth as part of the G20 agenda while also ensuring that the global financial safety net is adequate, well-resourced, and responsive, adding that women’s participation will be vital to an inclusive and sustainable economic recovery.

“This is a key priority for Australia across the G20. We want to hold the pandemic-induced backsliding and resume progress toward the Brisbane 25 by 25 goal,” he said, referring to the 2014 G20 initiative to reduce the gender gap in labor force participation by 25 percent by 2025.

Jadwat applauded the Women 20 (W20) engagement group for hosting a successful summit, which he said will feed strong outcomes into the leaders’ meeting.

“I had the great pleasure of meeting with W20 Sherpa Salma Al-Rashid and Chair Dr. Thoraya Obaid. We are very happy with the work they have been doing over the course of this year, including working with W20 representatives from Australia.”

Since Jadwat first assumed his position as ambassador to Saudi Arabia, strengthening relations between Australia and the Kingdom has been a priority.

FASTFACT

Australia’s consumer price index for 2020 rose 1.6% this quarter.

“It’s been an important mission for me to help build bridges between our two peoples. Australia’s relations with Saudi Arabia have been consistently friendly and constructive, but we can do even more together.”

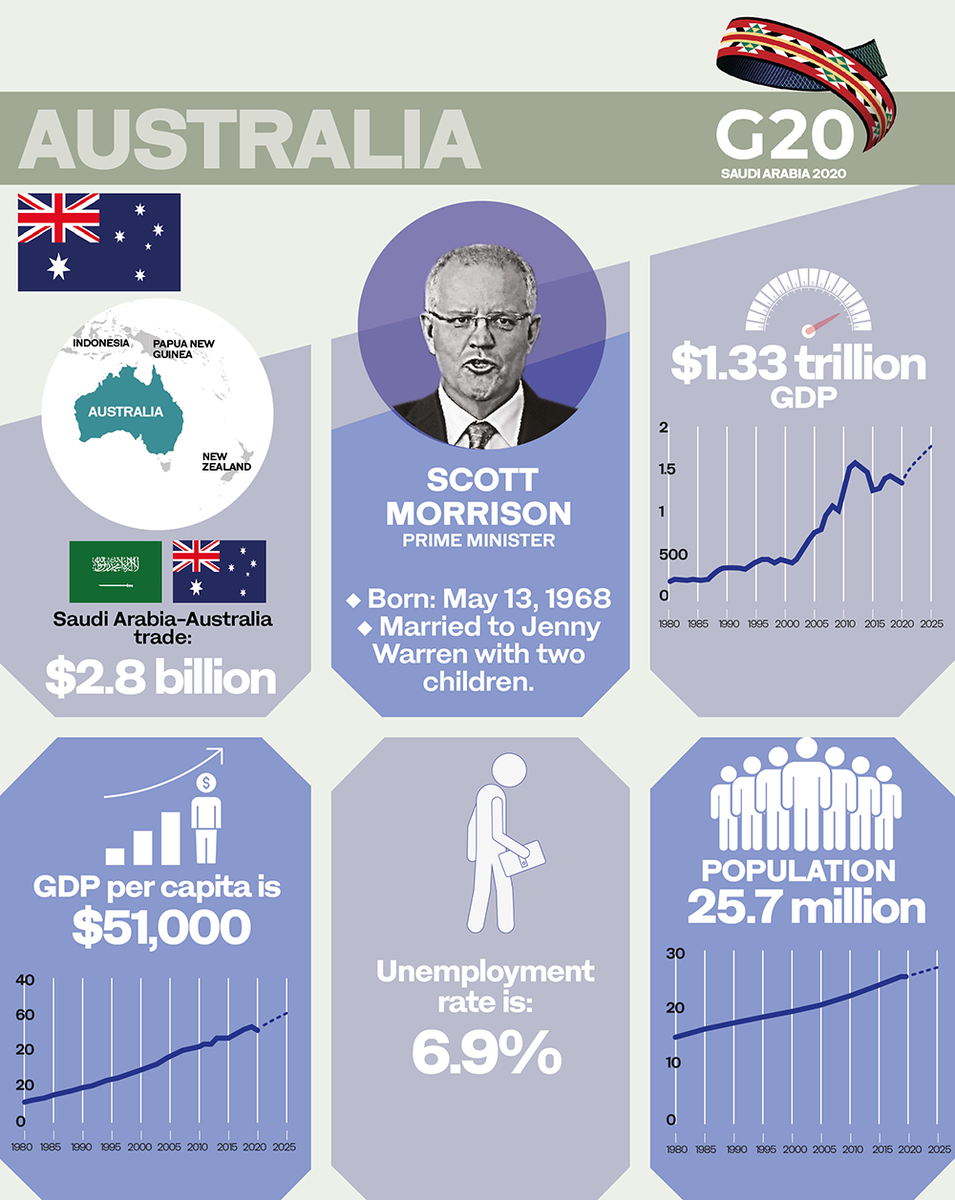

Jadwat said that although the two countries are relatively far away from each other geographically, both economies have strong complementarities. With similarly sized populations, large desert areas, and abundant natural resources, Jadwat pointed out that the cornerstone of Australia’s relations with Saudi Arabia is strong trade-economic ties.

“We have natural strengths in the energy sector, but we are not competitors. We both value technology and finding innovative ways to solve problems. We have much to offer Saudi Arabia in education mining, agriculture and tourism, especially as it diversifies its economy.”

Jadwat highlighted that a goal of Vision 2030 is to develop the tourism sector and that Australia has much experience in managing sustainable, environmentally friendly tourism projects, like in the Great Barrier Reef and other places throughout the country.

“I think we have a lot to offer in terms of our expertise in tourism and environmental management. Australia is a mining superpower that has helped make us the 13th largest economy in the world. I know there are a lot of unexplored natural resources in Saudi Arabia. So in terms of engineering and mineral exploration, Australia has a lot to offer.

“One of the things that I’m most proud of is the education relationship and the number of alumni from Australian universities who are here in Saudi Arabia. We also have thousands of Saudi students who continue to study every year in Australia. I think that’s a testament to the relationship between the two societies. I feel that those Saudi students who come back to the Kingdom become ambassadors for Australia as well,” he said.