RIYADH: The largest-ever meeting of the UN Convention to Combat Desertification has kicked off in Riyadh, with bolstering global drought resilience one of the key goals.

Running from Dec. 2 to 13, the first few days of COP16 are set to see a number of high-profile summits, ministerial dialogues, and announcements to address the pressing challenges associated with land degradation, degradation and drought.

French President Emmanuel Macron is expected to be among the attendees, as is the President of the World Bank Ajay Banga.

The opening day of the event will see Saudi Arabia use its presidency of the event to launch the Riyadh Global Drought Resilience Initiative, in a bid to accelerate international action in this area.

In tandem, the Saudi Green Initiative Forum, running from Dec. 2 to 3, will include hundreds of policymakers, business leaders and subject matter experts from across the world in a dedicated pavilion in the COP16 Green Zone.

The Second International Forum on Greening Technologies is also set to take place in the Green Zone between Dec 6-8, including dozens of tailored sessions to explore solutions, innovations, and lessons learned from global greening projects, alongside showcasing the scientific research associated with restoration projects around the world.

3:15 p.m. - Riyadh Global Drought Resilience Partnership announced

Saudi Arabia has announced the launch of the Riyadh Global Drought Resilience Partnership, supported by a $150 million investment, according to a top official.

Speaking during the first plenary meeting, COP16 president Abdulrahman Abdulmohsen Al-Fadhley explained that the initiative aims to promote multilateral efforts in the countries most impacted by drought.

“The launching of the Riyadh Global Drought Resilience Partnership aims at promoting multilateral efforts to promote resilience, namely in the countries most impacted by drought. It includes proactive partnerships to support the UNCCD,” Al-Fadhley said.

“It is my pleasure to announce that the government of the Kingdom of Saudi Arabia will support this initiative with the amount of $150 million in the coming 10 years,” he added.

2:46 p.m. - EU to ramp up colloboration

The EU is set to intensify global collaboration at COP16 in Riyadh, working with international partners to tackle desertification, land degradation, and drought while addressing food security, biodiversity loss, and water scarcity.

In a press release, the 27 member-state union said these issues are global challenges that require urgent action and scaling up of viable solutions, adding that they, exacerbated by climate change, also aggravate economic, social problems such as migration and forced displacement.

Jessika Roswall, commissioner for environment, water resilience, and competitive circular economy, who is representing the EU at COP16, said: “The world loses 100 million hectares of healthy and productive land every year - around twice the size of France. Without rich and fertile soils, we have no food. Without healthy land, people lose their livelihoods.”

The statement further said that the EU advocates for strengthening the implementation of the UNCCD both within the current framework and beyond 2030, underlining that it is crucial for the union that parties agree on a ‘solid budget’ for the Convention secretariat to carry out the decisions made at the COP.

1:58 p.m. – New group announced to support COP16 policy making

Osama Faqeeha, Saudi deputy minister of environment and advisor to the COP16 president.

Saudi Arabia aims to secure concrete outcomes from COP16 with the establishment of a “Friends of the Chair” group, tasked with drafting the Riyadh Policy Declaration, a key outcome document of the conference.

Osama Faqeeha, Saudi deputy minister of environment and advisor to the COP16 president, announced the formation of the group, emphasizing its role in shaping the conference’s ministerial declaration.

“The Friends of the Chair group will be facilitated by a group representing the COP presidency, and a report on the outcomes of its work will be submitted directly to me in my capacity as President,” Faqeeha stated.

12:52 p.m. – ‘Action cannot wait’

Amina Mohammed, deputy secretary-general of the UN, called for urgent global action, particularly around strengthening international cooperation on land degradation, ramping up restoration work, and mobilizing finance at scale.

“Land sustains us, and we are destroying it. Action cannot wait,” she said.

11:44 a.m - COP16 President speaks

COP16 President Abdulrahman Al-Fadhley, also the Kingdom’s minister of environment, used his speech to emphasized the Kingdom’s commitment to combating desertification, adding: “The Middle East is one of the regions most impacted by land degradation, drought, and desertification. We seek to address environmental challenges in partnership with the international community.”

The environment minister highlighted Vision 2030 as a cornerstone for the Kingdom’s green agenda, saying: “Protecting the environment and natural resources is essential for achieving sustainable development and quality of life.”

10.43 a.m. - Private sector funding crucial to tackling degradation, UN executive says

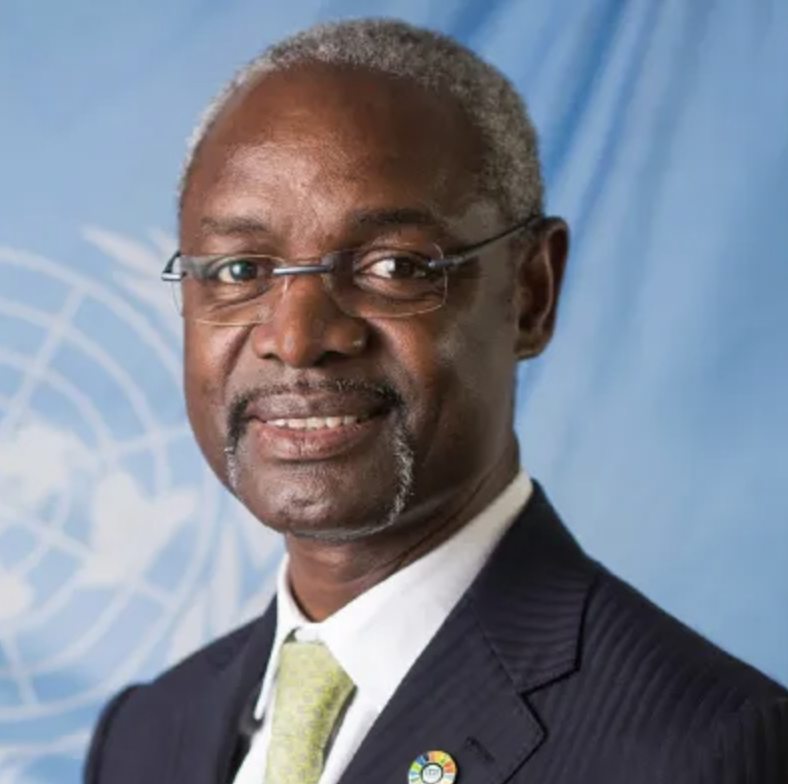

Ibrahim Thiaw, executive secretary of the UN Convention to Combat Desertification. UNCCD

Restoring the world’s degraded land and holding back its deserts will require at least $2.6 trillion in investment by the end of the decade, the UN executive overseeing global talks on the issue told Reuters, quantifying the cost for the first time.

More frequent and severe droughts as a result of climate change combined with the food needs of a rising population meant societies were at greater risk of upheaval unless action was taken, Ibrahim Thiaw said.

A large chunk of the around $1 billion a day that is required will need to come from the private sector, said Thiaw, who is executive secretary of the UN Convention to Combat Desertification.

“The bulk of the investments on land restoration in the world is coming from public money. And that is not right. Because essentially the main driver of land degradation in the world is food production... which is in the hands of the private sector,” Thiaw said, adding that as of now it provides only 6 percent of the money needed to rehabilitate damaged land.

“How come that one hand is degrading the land and the other hand has the charge of restoring it and repairing it?,” said Thiaw, whilst acknowledging the responsibility of governments to set and enforce good land-use policies and regulations.

With a growing population meaning that the world needs to produce twice as much food on the same amount of land, private sector investment would be critical, he said.

To hit $2.6 trillion — approaching the annual economic output of France — the world needs to close an annual gap of $278 billion, after just $66 billion was invested in 2022, the UN said.

10:36 a.m. - Abdulrahman Abdulmohsen Al-Fadhley elected as COP16 president